What’s Hawaii’s Environment Worth?

The coral reefs of the main Hawaiian Islands are worth $9.7 billion.

That’s the finding of a well-known 2002 study by Dutch economists Herman Cesar and Pieter van Beukering. They created an elaborate equation that summed up the various types of added value that coral reefs contribute to the local economy. They considered the portion of visitors’ travel spending that could be attributed to coral reefs, the equipment rentals and entry fees paid by snorkelers and scuba divers, the profits from fisheries, the research funds paid to scientists working on coral reefs and more.

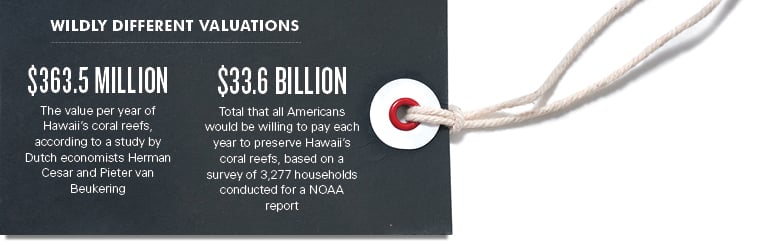

By Cesar and van Beukering’s calculation, all of that came to $363.5 million a year, 85 percent of which was from recreational activities. Their $9.7 billion figure is simply the “present value” of that revenue stream. It’s how much money you would have to have today to generate that same $363.5 million in annual revenue in perpetuity, given a modest interest rate of 3 percent. It’s a large number, but relatively simple arithmetic.

In 2004, another study, this one by the National Oceanic and Atmospheric Administration, used a different method to calculate how much Hawaii’s coral reefs are worth. They essentially just asked people. In a survey of 3,277 households around the United States, they asked, “How much would you be willing to pay to expand no-fishing zones around the main Hawaiian Islands to 25 percent of the reefs?” This question was really a proxy to find out people’s willingness to pay to protect and restore Hawaii’s reefs from the damage associated with economic development, things like overfishing and pollution. Similarly, the survey asked people how much they would be willing to pay for a Hawaii program that would repair damage caused by ships striking coral, a proxy for their willingness to pay for treating things like oil spills or groundings. In this study, “willingness to pay” is another way to express how much people value Hawaii’s coral reefs.

The answers researchers got were startling. The average American household said it would be willing to pay a total of $289.70 a year for the “protection and restoration of Hawaii’s degraded coral reefs.” Multiplied over the 116 million households in the country, that comes to $33.6 billion a year. If you apply the same modest 3 percent discount rate that Cesar and van Beukerling used, that yields an astonishing net present value of over $1 trillion – three orders of magnitude higher than what the earlier study found.

Why such a big difference in values? Which value is more accurate? Is it even possible to put a value on natural features like coral reefs? Why should we even care? Before we can begin to answer these questions, first we have to understand the technical and philosophical underpinnings of how economists look at nature.

What is Value?

Although economic valuation has been around since the 1940s, as a discipline, it really dates to the 1980s. Kirsten Oleson, an ecological economist in the Natural Resources and Environmental Management department at the University of Hawaii, says it began during the Ronald Reagan presidency. The idea was to do a cost-benefit analysis before any new regulatory policy. Over time, Oleson says, these cost-benefit analyses became de rigueur for most U.S. agencies so you could “assign benefits or damages to the environment.”

These cost-benefit analyses were probably intended to rein in what Reagan era conservatives thought were excessive regulations stemming from programs like the National Environmental Protection Act, the Clean Air Act and the Clean Water Act. The side effect, though, was to help make nature a central figure in economic models.

Nevertheless, economics, even when it evaluates nature, puts humans at the center. For example, economists tend to think of nature as the collection of services that an ecosystem provides to humans. The value of any ecosystem, then, is the sum of the values of all those services to people. Neoclassical economics – the kind of economics that you and I learned as undergraduates – divides these values into two broad categories, “use values” and “nonuse values.”

“Use values,” Oleson says, “can be split into direct, indirect and option values. The direct-use values are the classic ones. Often, these have some sort of market(ish) equivalent, like water. The direct values of a forest are things like timber, firewood, food, medicine – those kinds of things. They’re usually consumptive – we take them out of the environment – but they don’t have to be. There can also be direct uses like going to enjoy a beautiful area.

“Indirect uses are for things that support our well-being and enjoyment, but they might be harder to put a value on. Indirect values may be things like watershed protection, erosion control, microclimate regulation – those kinds of things.

“The option value is for something that we might want to use in the future, so we should keep it around. It might be because they’re irreplaceable, or it might be because we don’t know that we’re going to need them. The classic example would be the potential for pharmaceutical development from something in a rain forest or on a coral reef. As we erode biodiversity, we may also be eroding the cures to horrible diseases, so we may want to keep those around just in case we may need them in the future. Another example of an option value might be recreation. As beautiful areas become more scarce around the world, your beautiful area on, say, Maui, may become more valuable in the future.”

Although many of these indirect and option values may be difficult to put a number on, Oleson says, non-use values are even harder to quantify. “This is the idea that you can value something even though you’re never going to use it in any way. It may provide you with happy, glowing feelings simply because it exists. I’ll probably never see the Galapagos Islands, but the fact that the Galapagos are there, with their ecosystem and history and culture, improves my wellbeing. That’s the existence value. Then there’s the bequest value. This is the idea that we believe it’s critical that things exist for future generations. I want people to be able to visit Yosemite Valley. Or, I want future generations to be able to see a rural landscape in Hawaii. So we preserve them for the future. That’s the idea behind the bequest value. It improves my wellbeing to know that it will be there for future generations.”

These values frequently overlap. We might value a national park because we like the recreation it provides (direct use), the way its forests improve the quality of the water we drink (indirect use), the coal or natural gas buried deep beneath its soil (option use), the idea that our children and grandchildren might one day go there (bequest) and, for those of us who may never visit Yellowstone, Denali or Glacier National Park, the mere idea that they are there (existence).

Adding all those values gives you the total economic value of the park. But, first, an economist has to find a way to convert them all into dollar figures. Easier said than done.

Mechanics of Valuation

“Economists typically divide valuation into two umbrella groups,” says John Lynham, a researcher in the economics department at UH. “One is referred to as ‘revealed preference’, and the other is ‘stated preference.’ ”

Tourism is a great example of revealed preference, he says. “I buy a $500 flight, pay $100 to rent a car and $100 for a hotel room, just to go to Yosemite Valley and experience the natural beauty of that area. The entrance fee is only $20, but clearly I value that natural beauty way more than $20. I value it atleast $720, plus whatever all the other costs of getting there are.”

In other words, the value of Yosemite Valley to that visitor is revealed by the price he’s willing to pay to go there. In fact, the visitor might have been willing to pay even more to visit and he might have been willing to pay even if he never visited Yosemite. So, as with most revealed-preference methods of valuation, the travel-cost method almost always underestimates value. But it’s very popular, especially in court cases, because it’s easily defensible. Plus, the math is easy.

“In this case,” Lynham says, “I’ve clearly spent at least $720 to go to Yosemite Valley. If you add up me and everybody else that goes there, you get some number, whatever it is – let’s say $3 million. Clearly, people out there value this natural resource as worth at least $3 million.”

Travel cost is just one of a handful of revealed-preference methods of valuation. Another common method is something called “hedonic pricing.” Kim Burnett, an environmental economist at UH, and probably the most prolific producer of valuation data for natural resources in the state, used this approach for a project on the Big Island.

“I work largely in invasive species,” Burnett says. “That’s kind of the opposite of a natural resource. It’s a natural resource that’s bad. So, rather than thinking about how to optimally use it over time, you’re thinking about how do we optimally get rid of it.”

In other words: How much is it worth to us to eliminate a problem like an alien invasive?

Invasive species, such as coqui frogs, reduce the environment’s value. One way that’s measured: lower home prices where coquis are heard.

“Think about something like the coqui frog,” Burnett says. “Can we quantify how bad that’s going to be for the economy? Brooks Kaiser and I have a paper that basically looks at how property values have changed on the Big Island since the arrival of the coqui and if any of that change can be attributed to the presence of the frog. I think this data was from back in 2005, so it was early on, when the coqui problem was just getting bad in the Puna area.”

Brunett and Kaiser found a small but significantly lower price for properties where there had been a coqui frog complaint nearby compared to places where they had not been a complaint. And that was based on prices from almost a decade ago, before coqui frogs and their noise had spread to more areas and other islands with more expensive real estate. “The coqui frog thing is similar to locating a home near an airport or a train station,” she says.

“This technique is called ‘hedonic pricing,’ and it’s one of the most typical ways of evaluating things that don’t have market prices,” she says. It can work negatively, as with noise, or positively, such as with an ocean view. “If you have a lot of homes sold that are exactly the same, except one has an ocean view and one doesn’t, you can say that the increase in price is attributable to the ocean view.”

Hedonic pricing and travel cost are examples of indirect or revealed-value methods. Each has its own advantages and limits, but they’re fairly uncontroversial. The same can’t be said for the stated-preference approach. This method, which essentially asks people how much a ecological service is worth to them, or how much they would pay to give it up, requires that the people being surveyed understand sometimes complicated issues and that they respond honestly. That’s a big assumption.

“Because of that,” says John Lynham, “some people are very dismissive of stated preference. But others have spent their careers working on this – in particular, on how you can design surveys and ask people questions so they’re actually telling you the truth when they answer these questions.” Economics has also borrowed skills from fields like psychology and marketing to arrive at more nuanced and reliable valuations. These so-called direct methods may be the only way to assess those more elusive nonuse values.

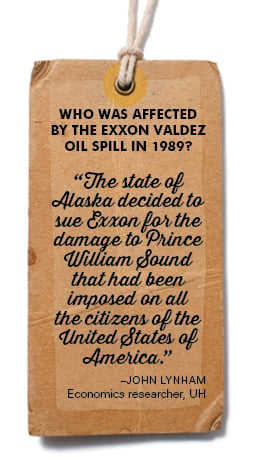

“When the Exxon-Valdez oil spill occurred,” Lynham says, “the state of Alaska decided to sue Exxon for the damage to Prince William Sound that had been imposed on all the citizens of the United States of America, including people who had never been there and may never, ever go there, but had still been hurt by the oil spill. The only way they could measure that damage was by contingent valuation. So, they conducted a really big, nationwide survey and the whole thing was set up so people would take it seriously and think this was something they might have to pay in the future. So, they were asked, ‘If, in an upcoming referendum, you had to pay an additional amount of income taxes up to $50 a year in order to prevent an oil spill from ever occurring again in Prince William Sound, would you vote for or against such a ballot proposal?’ If people said they would vote ‘Yes’, then they were asked, ‘What if it were $75?’ If they still said, ‘Yes,’ the amount kept going up; if they said, ‘No,’ the amount kept going down. I think the final value the state came up with was something like $2.8 billion.”

That might seem like a lot of money, but $2.8 billion was actually the low end of a range of values generated by the study; the high end was $7.19 billion. In the end, Exxon and the state of Alaska settled the suit for $1 billion, although Exxon is estimated to have also spent over $2 billion on cleanup and restoration after the spill. Using the additive principle of economic valuation, it’s possible to infer a $3 billion price to the ecosystems of Prince William Sound.

Koolau Watershed

Maybe the best example of an environmental valuation in Hawaii is a series of studies by UH professor Jim Roumasset and several coauthors that put an economic value on Oahu’s Koolau mountains.

Roumasset could be considered the father of ecosystem valuation in Hawaii. (Kim Burnett, who now has a lab of her own, was one of his graduate students.) As an environmental economist he’s partial to the commonplace data that characterize most of neoclassical economics. That makes him skeptical of the numbers generated in stated-preference studies.

“One of my former professors, Peter Diamond – who got a Nobel Prize in 2010 – once wrote a paper called, ‘Is Any Number Better Than No Number?’ He was kind of poking fun at how those valuations aren’t necessarily meaningful. So, we wanted to come up with a method that was more tangible. What we did was put a value on the (role the Koolau forests play in) recharging the Pearl Harbor aquifer. To the extent that the watershed recharges the ground water – and we know how to put a value on ground water, because the water is being sold at a certain price – we have methods in natural resource economics to find the present value of the whole aquifer, given certain assumptions about how fast it’s being depleted. So, if you’re putting more recharge into that aquifer, then that increases the present value of the whole aquifer. That was our method.”

That sounds straightforward, but, as anyone familiar with economic research knows, the actual calculations are more complex.

The core of Roumasset’s valuation is the assumption that the proliferation of alien invasives, such as pigs and miconea, impairs a native forest’s ability to retain water. As a result, there is more runoff and less water available to recharge the aquifer. As the water in the aquifer is reduced, the value of that water increases until it reaches the price of its replacement: desalinated water. Using those parameters, it’s relatively simple for an economist to calculate a value for the recharge service of the Koolau forest. Here’s how Roumasset describes the effect of the continued invasion of alien plants and animals in the watershed:

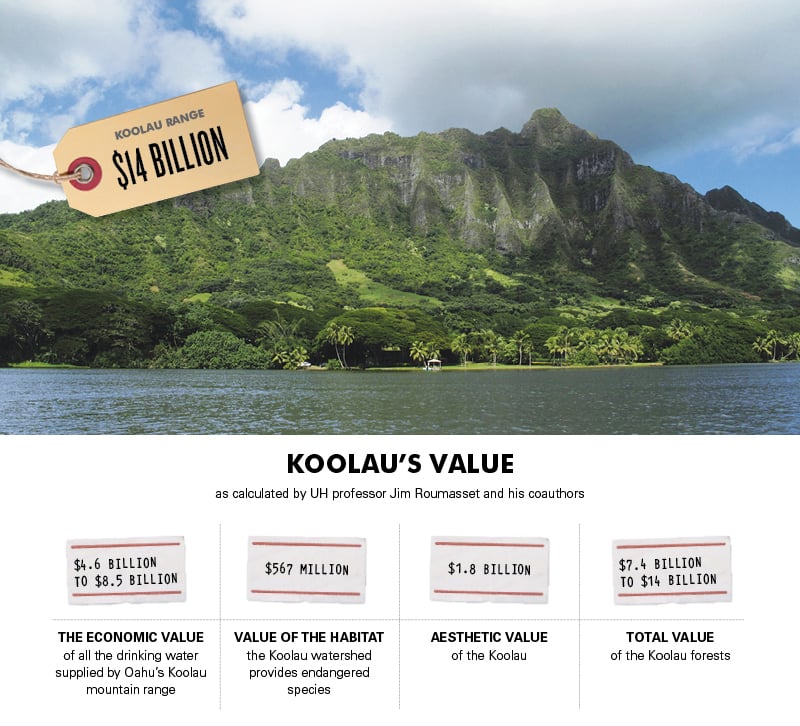

“This disturbance is assumed to reduce recharge to the Pearl Harbor Aquifer by 31 percent of the 133 million gallons per day that is currently attributable to the Koolaus. This implies that water use would have to decline and Oahu would have to resort to desalination as a water source more than 35 years earlier than if the forests were to remain intact. The present value of the resulting cost increases varies from $1.4 billion to $2.6 billion, depending on the discount rate. If there were a complete deforestation, e.g., due to a devastating fire, the value of the lost recharge would be from $4.6 billion to $8.5 billion.”

So, even using the conservative methods of neoclassical economics, Roumasset and his co-authors reach a minimum value of $4.6 billion for the Koolau. That’s just for the value of the recharge the Koolau watershed contributes to the aquifer. They go on to look at other ecological services provided by the forests of the Koolau. For example, they calculate that the increased runoff into the ocean associated with a 31 percent decrease in recharge would increase near-shore sedimentation by 28,217 tons a year, costing as much as $1.2 million a year to remove. Those costs have a present value of $26 million to $123 million.

To round out their valuation, Roumasset and co-authors also borrowed data from other researchers, even contingent valuations. For the value of endangered species sheltered in the Koolau watershed, they modified mainland data to reach a present value of $567 million. Similarly, for the more abstract quality of aesthetic value, they referred to a contingent valuation of open space on Oahu to come up with a present value of up to $1.8 billion. Ecotourism added an additional $1 billion.

Altogether, they evaluated 12 ecosystem services provided by the Koolau forests. Collectively, they represented $7.4 billion to $14 billion in net present value. It’s worth emphasizing: these are conservative estimates that focus on what these ecosystems are worth to the people actually living in or visiting Hawaii.

Uses of Valuation

Do all these mathematical gymnastics have any bearing on the real world? The economists think so, because they see their data as the key to good policy-making. Regina Ostergaard-Klem, an ecological economist at Hawaii Pacific University, puts it this way:

“People sometimes say, ‘How can you actually put a value on nature? Nature is priceless.’ But I believe you do have to put a value on it, some way or another, because policymakers and decisionmakers are doing that inherently. If you have a limited budget, and you have to determine where you’re going to place your funds, you have to figure out the different trade-offs. If there’s no value attached to these ecosystem services, then they’re just overlooked. But, if you put a value on them – even if it isn’t the true, inherent value, and we know that they’re really priceless – at least that gives them some value so they can hold their own versus some of the other options decisionmakers have when they think about where to put their limited funds.”

Sometimes, those political/environmental trade-offs are big ones. The decision in the 1930s to set aside thousands of acres for the Koolau forest reserve was obviously a big investment, but it has yielded significant returns. Roumasset’s research suggests that paying for even more forest conservation is a good investment. He calculates that a project that reduces the loss of forest over the next 10 years from 10 percent to 5 percent would yield a benefit-cost ratio of 50 to 1. To the rational policymaker, that looks like a good investment of public funds.

In a similar vein, Kim Burnett’s most recent work has focused on the value of water on the Big Island. She and her lab have been trying to quantify the value of conservation efforts that use fencing to keep pigs, goats, deer, horses and other animals out of native forests. This prevents them from turning into invasive forests. Bearing in mind that native forests retain more water than invasive ones, it’s possible to calculate the water saved in areas fenced off from animals that disturb native habitat. From there, Burnett says, it becomes a matter of arithmetic.

“Because we know how much it costs to maintain that fenced-in area, we can basically estimate the number of gallons of water saved per dollar of conservation. So, if you spend a dollar on conservation, you’re potentially saving however many dollars on water costs. The exact amount depends on exactly where you are and on the other characteristics of the forest, but this is kind of the first time anyone in Hawaii has been able to quantify the value of conservation in a meaningful way.”

Genuine Progress Indicator

Getting nature a seat at the table is the fundamental purpose of valuing natural capital, but, for the most part, it’s been a limited and ad hoc process until now. To make a real difference in how policy is made, valuation data has to be used more systematically.

Economist John Lynham echoes the opinion of most of his colleagues in the state: “Hawaii is so dependent on its natural beauty and environmental assets, I just think it would be a more accurate reflection on how the economy is doing, year to year, rather than just looking at the state’s gross domestic product (GDP) or its unemployment rate. I think something that captured the value of all the natural and physical capital here would be a better indicator of how we’re doing.”

As it happens, the state has been working on something like that. For the last two years, Kirsten Oleson and Regina Ostegaard-Klem have been using economic valuations to give policymakers a better accounting for how the state’s doing.

“We’ve been working on something called the Genuine Progress Indicator,” Oleson says. GPI, a process created in Maryland in the 1990s, and now used in at least five states and half a dozen countries, is an attempt to adjust the gross state product, the state’s version of GDP, for the environmental, economic and social changes that come along with economic development. Those adjustments can be either desirable or undesirable, but the idea is to make a fuller accounting of the state’s economic progress.

“GDP measures one thing,” Oleson says, “the output of an economy. But it doesn’t capture the flip side of the ledger. It doesn’t capture environmental and social costs. GPI is an attempt to give a more holistic metric for the economy. GDP is often held up as an indicator for how well we’re doing. But it was never intended for that. It was an indicator created in the Depression era, and was only intended to show what the output of your economy was. But, at this point, we recognize that output is a poor indicator for the economic welfare of a nation or a state. It would be like looking at just the outlays in your bank account without looking at how much is coming in.

“GPI starts at the same place as GDP, which is personal consumption expenditures – us buying things. But then it adjusts for things like economic inequality and – my part of this – environmental costs. If we’re losing farmlands, what was the value of that farmland? If we’re losing forests, what was the value of the forest lost? If we’re having water-quality incidents, what was the cost of those water-quality incidents? This is the flip side of economic development.”

It’s a worthy effort, but there are inevitable problems. First, Oleson and Ostergaard-Klem haven’t had the financial resources to do their own research, so they have relied on existing data. This is normal; Roumasset had to do the same thing for his Koolau valuation. There simply aren’t enough Hawaii-based valuations to draw from. Instead, Oleson and Ostergaard-Klem took mainland studies and applied those values to Hawaii’s ecosystem services. This technique, called “benefit transfer,” is uncomplicated in practice. You find a per-acre or per-person figure from a mainland study, and simply multiply by the Hawaii population or acreage. But Oleson and Ostergaard-Klem acknowledge that Hawaii’s island ecosystems often don’t have exact parallels on the mainland. Nevertheless, the current GPI process is a good start, they believe.

Some examples: In 2012, water pollution cost the state $42 million, using Maryland’s figure of $130 per person per year multiplied by the percentage of streams considered “degraded” by the EPA. A surprising 54-acre gain in wetlands from 2001 to 2005 netted the state $305,000, based on Maryland’s $1,973 per acre calculation of the value of environmental services provided by wetlands. Noise pollution cost us $109 million, also using Maryland estimates.

But it’s not all based on mainland examples. Using the $1,690 per acre figure from Roumasset’s valuation of the Koolau forests, a net gain of 6,400 acres of forested lands between 2000 and 2005 added $11 million in net value to the state’s accounts.

All these environmental factors are supplemented by social changes that are also normally ignored by GDP.

How Much is Too Much?

What about radically different valuations of the same ecosystem, such as the two divergent values placed on Hawaii’s coral? To some extent, it comes down to understanding what those different valuations were actually measuring. Kirsten Oleson explains the differences between the NOAA study and the one done by Cesar and van Beukering.

“What the NOAA study set out to do,” she says, “was capture the total economic value of the reefs – so, the use and the nonuse value. Cesar and van Beukering only did a subset of that value. And the Cesar and van Beukering study predominantly used revealed-preference methods, looking at land values, for example. They also did a choice model to get some of the stated choices for reef services, and they did market for fisheries. But, whenever they could, they used the market method. When they couldn’t, they used revealed. And, when they couldn’t do either of those, they used stated-choice methods. They moved up the ladder like this.

“The difference was that the NOAA study just did the stated choice, which tries to capture both use and non-use value all in one question. I think their question was something like: ‘How much do you value the coral reefs of Hawaii?’ with a narrative before that about the importance and beauty of the reef and things like that. They surveyed a couple of thousand people all around the United States; whereas, Cesar and van Beukering limited their valuation to the people in Hawaii.”

That accounts for most differences between the two studies, but Oleson also says the focus of the NOAA study was inherently flawed.

“The NOAA study was really set up as an experiment to test web-based methodology for community valuation and statistical contingent valuation. So, the purpose of that study was not really the number; the purpose was testing the methodology. They’ve actually gotten a lot of flack about the number.”

Oleson notes that Ostergaard-Klem actually uses the NOAA report in her classes at HPU, making students go through all the things that are wrong with it. Similarly, she says, John Dixon, one of the most respected senior economists in the state, says the study “doesn’t pass the sniff test.” The idea that coral reefs are worth three times more than rain forests simply doesn’t wash.

“After you do one of these valuations,” Oleson says, “you have to ask yourself, ‘Does what I’m saying make ecological sense?’ ” For her, and for most Hawaii economists, the Cesar and van Beukering valuation is more credible.

But, before we cast the NOAA numbers out, let’s make a layman’s back-of-the-envelope calculation: If we take the per capita value of Hawaii’s coral reefs in the Cesar and van Beukering study – the $9.7 billion divided by the population of Hawaii, about 1.3 million – you get a figure just shy of $7,500 per person. If you make that same calculation using the NOAA numbers – about $1 trillion divided by the U.S. population of 319 million – you get a value of less than $3,200 per person. Now which figure seems extreme?

If the state of Hawaii chose to cash in its coral reefs tomorrow, to sell off the beauty and fishes and shoreline protection and all the other ecosystem services that coral reefs provide and distribute that money to its citizens, which figure would you want?