Inevitable Change

Soon – maybe even by the time you read this article – the state’s largest company, Hawaiian Electric Industries, will begin a radical transformation from the stodgy monopoly we’ve known for 124 years, into a much more nimble and competitive company, one that’s prepared for the challenges facing a 21st-century electric utility.

No, I’m not referring to the company’s proposed acquisition by Florida energy giant NextEra. That deal, if ever it happens, will likely take a year or more to make its way through a gauntlet of regulatory, legislative and legal obstacles, any of which could still scuttle the deal. A Hawaii Island group has even proposed converting HELCO, Hawaiian Electric’s Big Island subsidiary, into a customer-owned cooperative, much like KIUC, Kauai’s electric utility. But even if the merger/acquisition succeeds, the company that emerges may not look all that different from the company that went into it – with new leadership and larger economies of scale, perhaps, but governed by the same regulatory and economic paradigms that apply to Hawaiian Electric.

The coming transformation that I’m talking about, though, is much more fundamental than a simple stock swap or the consolidation of a few back-office functions. I’m talking about a wholesale change in the utility’s business model – in its basic mission, what it gets paid for and, consequently, its relationship with customers and investors. What’s more, despite the dramatic nature of the proposed changes – which the Public Utilities Commission may rule on within months, or even weeks – they’re largely uncontested by the parties involved (including NextEra, which has said its acquisition of HEI isn’t contingent on the outcome of any issue before the PUC). In short, change is inevitable.

So, what will this new utility look like? To understand that, we first need to take a look Hawaiian Electric’s current business model.

COST-PLUS SYSTEM

The regulation of electric utility monopolies, like HECO on Oahu and its sister utilities on Maui and Hawaii Island, is simply the acknowledgement of the critical role that electric power plays in any economy. This regulation embodies a basic compact between the utility and its customers: The utility agrees to supply all customers with reliable, reasonably priced electricity; in exchange, regulators allow the utility a monopoly on the supply of electricity and guarantee the company a reasonable return on its investment. This system accomplishes two things: First, giving the utility a monopoly keeps costs down by eliminating the duplication of expensive infrastructure, like transmission lines and power plants. This saves customers money. Second, guaranteeing returns, over and above reasonable expenses, encourages adequate investment in that infrastructure. This ensures customers have reliable electric service over the long term.

For more than half a century, regulators have enforced this compact largely by controlling the rates that electric utilities can charge customers. The basic principal has been that the utility is entitled to recover all reasonable costs, plus a specified profit. Hawaii statutes, for example, permit the HECO companies up to a 10 percent profit above allowable expenses. This regulatory scheme is known as the “cost-plus” approach. Critically, those costs include not only operations and maintenance expenses, such as labor and fuel, but also the cost of capital and the depreciation of capital investments. Put another way, the more capital investment a utility makes, the higher its allowed earnings.

This system worked for a long time. As the economy and demand grew, utilities invested in building more power plants and the transmission and distribution lines to get that power to new customers. And, because there were more customers, the costs associated with all that capital investment could be spread over a larger pool. In fact, as the utilities’ economies of scale grew, the real price of electricity declined for most customers. At the same time, the increase in capital costs, and thus rate base, meant more profit for the utilities. It was a classic win-win situation.

But it wouldn’t last.

THE PROBLEM

“If the only tool you have is a hammer,” Ronald Binz likes to say, “all your problems start to look like nails.”

Binz is a former chairman of the Colorado PUC and a one-time President Obama nominee to run the Department of Energy. Now a highly regarded consultant in the electric utility industry, he’s working with the Blue Planet Foundation, a driving force in Hawaii’s evolving energy community, to devise a new regulatory scheme for Hawaiian Electric. For Binz, the old saw about a hammer and nails perfectly describes the danger of basing a utility’s income on its capital investments.

“This induces some biases,” he says. “For example, it’s well understood in academic circles that, when you base the profitability of a utility on how much they have invested, they have a natural incentive toward spending capital whenever they approach a challenge.”

In other words, even if problems can be addressed in other ways, the utility is more likely to spend its way to a solution. For example, faced with a shortfall in generation, a utility has more incentive to invest in new power plants than to promote more efficiency, even if the efficiency approach is cheaper and more effective. That’s because traditional regulatory schemes reward utilities for capital investments and sometimes penalize them for efficiency by reducing the rates they’re allowed to charge.

“IF THE ONLY TOOL YOU HAVE IS A HAMMER, ALL YOUR PROBLEMS START TO LOOK LIKE NAILS.”

Ronald Binz

Former chair, Colorado PUC

There’s even a term for this phenomenon, Binz says. It’s called the Averch-Johnson effect, or sometimes the gold-plated water-cooler effect, because of companies’ willingness to invest in high cost, low-value projects that yield higher returns because of their expense. This is the kind of perverse incentive created by traditional utility regulation.

The cost-plus model evolved in an era of low energy prices and growing demand. What happens when prices soar and demand declines? That’s exactly what happened in Hawaii (and, to a lesser extent, in mainland markets). Because we still rely on expensive, imported oil to produce most of our electricity, HEI customers pay the highest rates in the country – as much as five or six times what NextEra customers in Florida pay, for example. Largely as a consequence of these high prices, demand for electricity in Hawaii has been falling steadily for more than a decade. Some of this decline is because of the growing popularity of rooftop solar, which, because of government subsidies and other public-policy initiatives, now offers some customers lower energy prices than the utility. Most of the decline in demand, though, comes from increased efficiency. Even customers without rooftop solar are simply using less electricity than they used to.

This scenario of declining demand and increasing fuel prices is potentially a death spiral for a utility. It suggests a future with fewer customers paying higher costs for an infrastructure in increasingly worse repair.

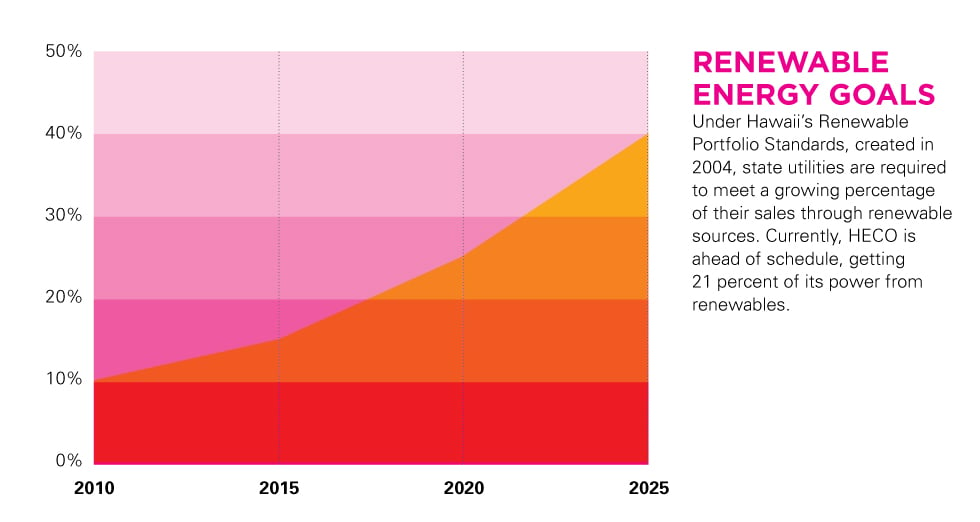

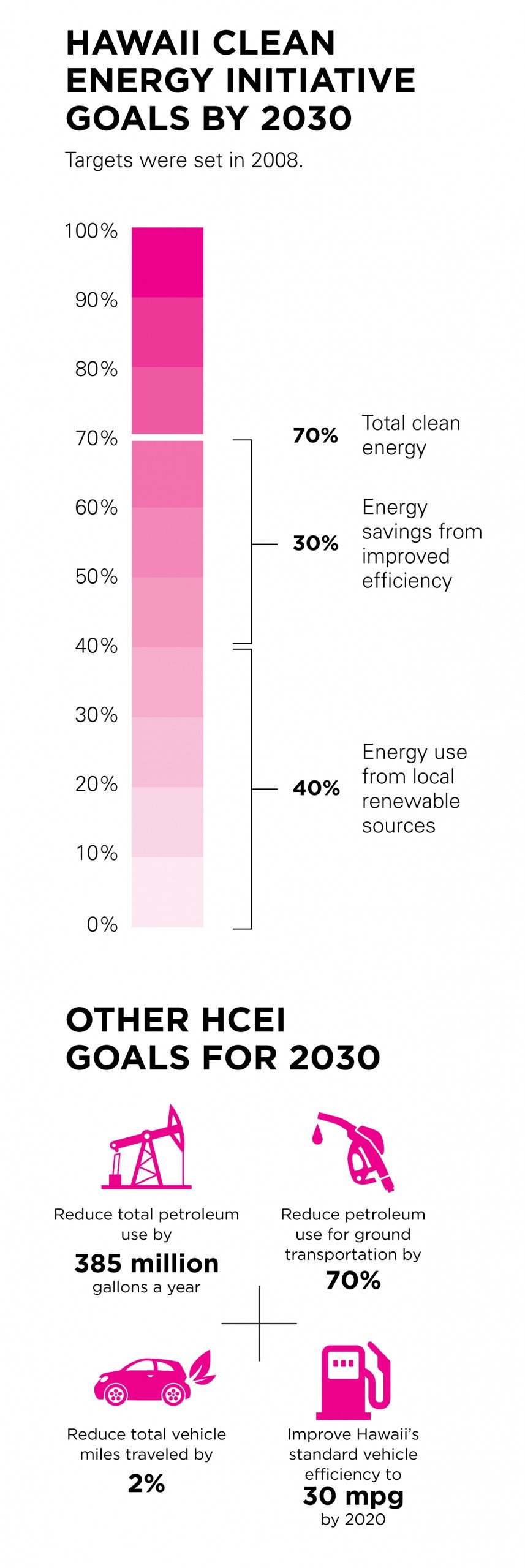

All of this was happening in the context of sweeping changes in the state’s energy policy, including the Hawaii Clean Energy Initiative, which set the state’s broad goals to move away from fossil fuels; the renewable-energy portfolio standards, which specify how much wind and solar energy the state will adopt; and energy-efficiency standards, which spell out how the state will reduce its overall energy consumption. In a report prepared for Hawaiian Electric, the consulting firm The Brattle Group points out what this new energy paradigm means for the utility:

“These path-breaking policies require that the companies help facilitate a third-party energy efficiency provider to achieve by 2030 at least a 30 percent reduction in delivered electricity. The companies must implement a long-term resource plan that provides 40 percent of the generation from renewable sources. Already electricity sales have been falling every year since 2004 at an average rate of over 1 percent per year. The renewable production is about 18 percent, ahead of the 2015 target of 15 percent.”

So, as much as Hawaii’s energy community likes to bash Hawaiian Electric, the utility has made some advances. Even so, in the energy community – and even to the general public – there’s a great deal of frustration with the pace of the utility’s progress and what many see as its lack of urgency.

INCLINATIONS

Nowhere is that frustration clearer than in a remarkable white paper called the “Commission’s Inclinations on the Future of Hawaii’s Electric Utilities,” which was published last April by the PUC. In this tartly worded document, the commission complains in detail about the utility’s lack of urgency and what looks like foot-dragging when it comes to developing a business plan suitable for the new energy paradigm. In the absence of such a long-term strategy, the report notes, “it is difficult to ascertain whether HECO Companies’ increasing capital investments are strategic investments or simply a series of unrelated capital projects to expand utility rate base and increase profits appearing to provide little or limited long-term customer value.”

The “Inclinations” piece also highlights some of the capabilities the commission foresees as critical for the utility’s future, including the ability to integrate large quantities of utility-scale renewable-energy resources, to add increasing amounts of rooftop solar to the grid, and to retire old fossil-fuel generating plants, replacing them with modern, flexible power sources and new technologies, like energy storage and demand response.

The commission also identifies elements in the utility’s current business model that “may impede this transition.” For example, the commission points out the utility’s ownership of generation plants “creates inherent financial conflicts that can complicate, and in some cases impede, development of independent generation projects.” In other words, the utility may prefer its own generation over the more efficient generation of an independent provider.

Most important, though, “Inclinations” notes that the current cost-plus regulatory model simply cannot provide the necessary incentives for a modern utility. It remarks that, because of the pass-through of fuel costs, “the HECO Companies have no direct financial incentive – reward or penalty – to stabilize and reduce power supply costs, minimize curtailment of low-cost renewable energy, or maximize use of cost-effective renewable-energy resources.” This, despite the fact that fuel charges are the utility’s largest cost.

Similarly, the report says, the utility has no financial incentives to pursue independent power agreements for clean-energy projects or to accelerate the retirement of its own fossil-fuel plants. Yet these are both high-priority public-policy goals.

In response to this quandary, the commission suggests some of the elements of a regulatory system that might align the utility’s behavior more closely with the tenets of the Hawaii Clean Energy Initiative and the state’s other energy goals. They include incentives to increase renewable energy, retire old fossil-fuel generation and invest in modernizing the grid. Significantly, they also include “a prohibition on developing new generation resources or undertaking major modifications to existing utility generation units by HECO Companies.”

That’s a pretty radical re-vision of the state’s monopoly electric utility.

The commission’s white paper still puts Hawaiian Electric at the center of the state’s energy future, noting that, “With new incentive mechanisms that better align utility performance with customers’ interests and public policy, a financially healthy utility can be synonymous with achieving Hawaii’s clean energy future.” Nevertheless, the overall tone of the “Inclinations” piece is that of an urgent call to action.

INCENTIVE-BASED REGULATION

As it happens, the opportunity for change is imminent.

In 2012, the PUC issued a much-anticipated order “decoupling” the utility’s earnings from its sales volume. This was supposed to address another of those perverse incentives embedded in the old regulatory scheme. At a time when official state policy was to reduce energy consumption, the utility’s revenues were still based on how much energy it sold. So, it had no incentive to encourage more efficiency, even though more efficiency was one of the signal goals of the Hawaii Clean Energy Initiative. The decoupling ruling mitigated this conflict.

Decoupling also addressed one of the utility’s greatest concerns. Historically, utilities recouped increased costs through a quasi-judicial process know as a rate case. In this time-consuming and expensive procedure, the utility presented the PUC with documentation of its higher costs, and the commission decided if the expenses were prudent and reasonable. Because of the interval between rate cases, sometimes it took a long time for the utility to recoup its costs. The decoupling order, though, created a new tool called the Revenue Adjustment Mechanism, which allowed the utility to recoup some of those costs between rate cases.

But the new regulation was still flawed. As Ronald Binz points out, “Decoupling disassociated profitability from sales. In other words, it took away the need to sell more in order to make a profit. But, even under decoupling, you still had cost-plus regulation.”

Fortunately, the PUC included a provision in its decoupling order that required a review in two years to see how it was working. That review, which got underway last year, presents an opportunity to also review the broader nature of how the utility is regulated, and what its business model should look like. Moreover, the PUC’s “Inclinations” piece provides a set of expectations that any proposals will have to address. So, this docket sets the stage for a comprehensive redesign of how Hawaii’s largest company operates.

Although many entities have been party to this docket – including the Hawaii Solar Energy Association, Earthjustice and the Hawaii Renewable Energy Alliance – the main proposal for a new regulatory system can be found in a PUC filing by the Blue Planet Foundation, based on expert testimony from Binz.

Blue Planet calls the system “The Hawaii Clean Energy IBR.” This incentive-based regulation, based on the British system regulating companies that transmit electricity around the country, is designed to more closely align the utilities’ operations with the interests of customers and the state’s clean-energy goals. As the name suggests, it depends primarily on incentives, rather than rules, to achieve these goals.

Blue Planet and Binz identify several key features of the new regulatory model. Among them:

- The utility will be compensated for achieving its clean-energy objectives, as justified by well-defined measures

- Rate increases will no longer be based on historic costs. Instead, performance incentives would reward the utility for doing the things the PUC wants it to do, like reducing the use of fossil fuel, improving customer service, maintaining the reliability of the grid and increasing the amount of “nonutility, nonfossil generation and demand-response resources.”

- A new five-year business plan will be negotiated by a group of stakeholders. This will “describe the utility’s specific clean-energy commitments over a specified time-frame, the achievement of which may allow them to earn additional revenues.”

- The Energy Cost Adjustment Clause, which allows the utility to pass fuel costs through to ratepayers, will be phased out.

Adopting a regulatory model that includes these features would certainly transform the utility, but Blue Planet goes even further, taking some of the PUC’s concepts to their logical conclusion.

For example, what would Hawaiian Electric look like if it no longer generated power? Blue Planet suggests converting the utility to a “tolling model” that would “rent generation capacity” from independent power providers instead of owning and operating power plants. Blue Planet speculates that “under this alternative business model, the HECO Companies would effectively over time become the ‘independent’ power supply integrator and operator of Hawaii’s power supply system.”

In this way, Hawaiian Electric might begin to resemble Independent System Operators on the mainland. These federally mandated entities don’t usually produce electricity; they manage and coordinate the distribution of electrical power between utilities within a state.

Blue Planet thinks that’s a good direction for Hawaiian Electric to evolve: “An already significant portion of HECO’s current utility net plant in service (rate base) is comprised of energy delivery, not generation, capital investments; consequently, the major portion of HECO’s total authorized common equity net income is already being derived from the energy delivery function.”

Once again, that’s a dramatic change for a small, island utility to undergo. Imagine a Hawaiian Electric that has no power plants and is paid based in part on the quality of the service it provides customers and the amount of renewable energy it integrates into the grid. That’s the kind of radical change possible under Blue Planet’s Hawaii Clean Energy IBR. Yet, no one seems to be balking.

DIFFERENCES OF OPINION

There are, of course, differences between the positions of Blue Planet and Hawaiian Electric. For example, the Blue Planet proposal envisions many of the regulatory changes taking place concurrently with the stakeholder meetings that develop the utility’s new business plan. Hawaiian Electric thinks that’s putting the cart before the horse.

Joe Viola, HECO’s VP for regulatory affairs, puts it this way, “Our core plans, such as the comprehensive Power Supply Improvement Plans filed in 2014 at the direction of the PUC, need to be reviewed by the PUC. Our regulatory model should provide incentives to achieve the objectives and goals of whatever plans are ultimately approved by the PUC. So, it’s important to have those objectives and goals established before a new regulatory model is adopted.”

Note that, even within this difference of opinion, there’s a fundamental agreement on the idea that incentives should match objectives and goals.

Another area of modest conflict deals with whether IBR should be tied in some way to capital investments. Viola says, “The incentive-based ratemaking model must be flexible enough to account for the significant investments and changes in operations that will occur as we transform the way we do business, facilitating the addition of more renewable energy. The incentives should be based on achievements that are reasonably under our control. We understand Blue Planet’s position to be that there should be no connection between the change in revenue levels and changes in the cost of providing service, but rather there should be a cap that adjusts according to an external inflation index.”

This, too, is a matter of degree and detail. Hawaiian Electric isn’t saying that it opposes IBR, just that the plan needs to provide the utility with the resources necessary to accomplish its goals. These types of disputes can likely be dealt with by the stakeholder group working on the utility’s new business model.

The biggest difference between the positions of Hawaiian Electric and the Blue Planet model of IBR is in how they propose to deal with fuel costs. Under the current system, the so-called Energy Cost Adjustment Clause (ECAC on your electricity bill) passes all of the utility’s fuel costs through to customers. That means ratepayers absorb all the risk of rising fuel costs. Hawaiian Electric and its shareholders are completely insulated from that risk. According to Blue Planet, this arrangement doesn’t give the utility any incentive to reduce fuel costs or – maybe more important – to “maximize the use of cost-effective renewable-energy resources.” Because of the fuel cost pass through, it may actually be more profitable for the utility to use dirtier and more expensive fossil-fuel generation than clean and relatively cheap alternatives, like wind or solar.

Blue Planet proposes a couple of ways by which the utility can share in the risk. Under one scenario, only part of the change in fuel prices would be passed through to customers. In their example, 80 percent of the variation in fuel cost would remain a pass through to customers, but the utility would “own” the other 20 percent. In other words, if fuel prices increase by 10 percent, customers would pay for 8 percent, but the utility would be responsible for the other 2 percent. Conversely, if the utility were able to reduce fuel costs by 10 percent, 8 percent would go back to the customer through rate adjustments, but the utility could keep its 2 percent as additional profit. This has the added benefit of giving the utility an incentive to find cheaper alternatives to fossil fuel.

Blue Planet also proposes the PUC eliminate an arcane form of regulation known as “the heat-rate adjustment.” This mechanism was intended to make sure the utility operated its generation plants as efficiently as possible by making sure they use the least amount of heat to produce the most amount of power. But, as Blue Planet points out, “The heat rate is lowered by maximizing the use of these facilities and maximizing their use is contrary to Hawaii clean energy statutory mandates and policy objectives.”

All of these positions are in line with the conclusions in the PUC’s “Inclinations” report. In addition, Blue Planet points out that phasing out the fuel pass-through would be consistent with the Hawaii statute, “which requires that the ECAC ‘[f]airly share the risk of fuel cost changes between the public utility and its customers’ and ‘[p]rovide the public utility with sufficient incentive to reasonably manage or lower its fuel costs and encourage greater use of renewable energy[.]’ ” Hawaiian Electric, of course, has a different take.

Joe Viola says, “This recommendation would prevent us from recovering fuel-cost changes due to fuel-price fluctuations over which we have no control. It would also limit the pass through of fuel-cost decreases to customers when the price of fuel drops. For example, as you know, recent fuel prices have dropped considerably. Those savings are being passed on to our customers each month. February 2015 electric bills on Oahu are the lowest they¹ve been in four years and customers will actually see credits (instead of increases) on their electric bills on the ECAC line item on their bill.”

Viola also worries that eliminating or modifying the ECAC would affect Hawaiian Electric on the capital markets. “It would make it much more difficult to raise capital at reasonable rates needed to support the investment in grid. Customers would end up having to pay for higher interest rates for any debt needed to finance capital projects. Furthermore, if the company isn’t able to generate enough revenues to support its operations, eventually customers will be hurt either through degraded service, higher rates or both, and, ironically, the achievement of clean energy goals would be delayed. This is the reason that 42 of the 50 states provide a dollar-for-dollar pass through of market-driven changes in fuel and purchased power costs. Such a policy is appropriate since utilities cannot control the prices in fuel markets.”

Joe Wharton of The Brattle Group emphasizes this point. “By and large,” he says, “everywhere you look, the cost of fuel and power purchase is something that’s treated as a pass-through cost. That’s because, aside from hedging, the utility has essentially no control over these costs.”

He also points out that the policy of passing through fuel costs is relatively new, designed to address the modern volatility of oil prices. “I’m old enough that I experienced the 1973 oil embargo, after the Yom Kippur War. That was the first time our source of fuel was cut off. Up to that point, the cost of fuel wasn’t treated separately.” Historically, he points out, oil prices had increased less than 2 percent a year. With the embargo, though, the price of oil went from just under $3 a barrel in 1973 to over $12 a barrel by the end of 1974. This quadrupling of fuel costs threatened the viability of utilities that relied heavily on oil-based generation, especially given the slow regulatory process of adjusting rates. Policies like the ECAC were enacted to protect utilities from this sort of volatility. And it’s not as if this volatility has ended. Last year’s plunging oil prices were the flip side of the same volatility that sent prices spiking in 2008. So Hawaiian Electric has a point. The question for the PUC, of course, is whether retaining the ECAC collides with today’s goals, such as bringing more renewable energy onto the grid.

Viola doesn’t think so. “If the desire is to provide an incentive for us to decrease use of fossil fuels, there are incentives that can be developed with goals based on how much oil our companies use rather than on the cost of that oil. In reality, we¹ve reduced consumption of oil by approximately 20 percent between 2008 and 2013, and our energy plans calling for 65 percent renewable energy by 2030, if approved, would result in much larger reductions in oil usage.”

In these instances of disagreement, it’s probably instructive to remember what the PUC had to say in “Inclinations”: “Simply stated, the utility is insulated and has no direct financial ‘skin in the game’ as to whether fuel costs, and, by extension, the ECAC surcharges increase or decrease.” With such pronounced guidance from the regulator, it’s hard not to see the parties reaching a quick accord, even on the most contentious issue.

CONSENSUS

These are relatively minor differences, anyway. The prevailing sense is the parties involved in the IRB discussions are ripe for a deal.

“In principal, I agree entirely,” says Joe Wharton part of The Brattle Group’s consulting team for Hawaiian Electric. “Everybody wants the utility to meet their very aggressive clean-energy goals. Everybody wants to increase the integration of renewable energy. Everybody wants HECO to have enough revenue to attract the capital they need to invest in new infrastructure. So, yes, I think there’s a deal to be made here. Of course, deals are hung up by a lot of things.”

It’s worth noting that The Brattle Group principal Peter Fox-Penner has written a much-cited paper extolling the virtues of RIIO, the British version of IBR. Even the expert testimony The Brattle Group submitted for Hawaiian Electric echoes many of the contentions in the Blue Planet proposal and the PUC’s “Inclinations” report.

Viola agrees, though he feels compelled to point out that, even without IBR, the utility has done a good job of helping the state reach its clean-energy goals. “It’s notable,” he says, “that our utilities, with 21 percent of customer energy needs supplied by renewable energy in 2014, are well ahead of the 2015 renewable portfolio standard of 15 percent. We also lead the nation, by far, in percentage of customers with distributed solar systems (largely rooftop solar) (about 20 times more than the national average). So, we believe the current decoupling mechanism has been achieving its intended purpose.

“At the same time, we agree with Blue Planet that a properly designed incentive-based regulatory model can benefit both customers and the utilities. For example, targeted performance incentives could be established to support achieving desired outcomes such as reliability or clean-energy targets. We also agree that it makes sense for incentives to be ‘symmetrical,’ that is, utilities would be rewarded for achieving established targets, but also incur financial consequences for not doing so. … This new regulatory model would eventually replace the existing decoupling mechanism.”

That’s pretty close to a consensus.

There’s still a wild card in all this, though. Since the “Inclinations” piece was written, we’ve gotten a new governor and Hermina Morita, the chair of the Public Utilities Commission, has retired. With Randy Iwase as the new chair, it may take longer than expected for the PUC to work out these issues. It’s worth noting, though, that commission votes only require a simple majority, so whatever they have already set in motion might not depend on how the new chair votes. Morita says Iwase has the skills he’ll need to be a successful chair. This highlights one of the state’s main assets as it goes through this regulatory change: For such a small state, there’s a surprising level of competence in the people involved in this process. That’s key, because these are big, hairy issues, and solving them will require the contributions of many people.

Ronald Binz, for one, isn’t concerned. “You’ve got a lot of horsepower here,” he says. “Both inside and outside the commission. In fact, I’ve rarely seen a group of parties as competent and prepared as the people were for this docket. Everybody put on a very impressive show. Each of the parties really put in a lot of work. So, I think there’s enough talent collectively in Hawaii to get these things done.”

LEARN MORE

Here’s a shortcut link to the PUC docket no 2013-00141, which covers the transformation of the Hawaiian Electric utilities: tinyurl.com/nvfhpsb

To date, this docket contains 177 documents and thousands of pages of testimony related to the HECO decoupling agreement and how the HECO companies are regulated. This is where you can find Blue Planet’s Hawaii Clean Energy IBR proposal, as well as comments from HECO, the state’s consumer advocate, the counties and each of the other interveners.

If you want to read the PUC’s “Inclinations” statement in full, here’s a shortcut: tinyurl.com/ovnvhv5.