Hurricanes: The Other Checklist

The usual prep list does not tell you such things as:

- Which island is more likely to get hit frequently?

- Which islands are more likely to get hit severely? (The answers are different.)

- How can you tell how much damage a hurricane is likely to cause, from its name?

- What roof shape is likely to be strongest in a hurricane?

- What building size is stronger in a hurricane?

- Will “hurricane insurance” alone cover ALL damage generated by a hurricane? (The answer is probably not, and we’ll explain what you should do about that.)

If you live in Hawaii, you’ve been through the hurricane prep drill: you’ve filled the cars with gas and the bathtubs with water, stocked up on batteries, toilet paper and, sometimes (you know who you are), wine. But far fewer of us have actually lived through a hurricane and its aftermath, and fewer still, a “major” hurricane, defined as a Category 3 storm or above.

Collapsed structure in Hanapepe, Kauai. Photo by Nick Galante.

With the June to November 2017 hurricane season approaching, it’s a good time to take stock. At Hawaii Business, we strive to bring you information you don’t already have. So, while most hurricane-related stories focus on preparation that starts right before a storm hits, we asked ourselves what else – financially, economically, scientifically – might be useful to know before the next one rolls through.

HURRICANES, TYPHOONS & CYCLONES, OH MY

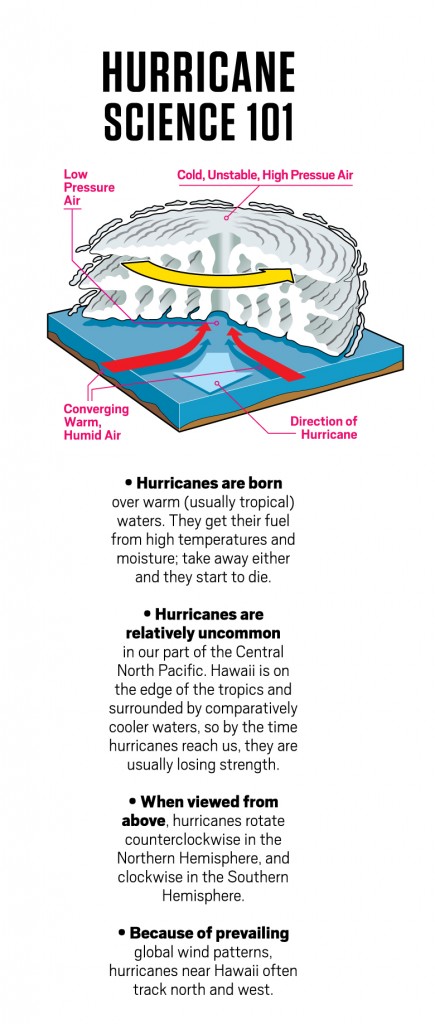

Ever notice that hurricanes only seem to occur relatively close to the United States? The rotating circular storms we call hurricanes are called cyclones when they occur in most of the Southern Hemisphere and the Indian Ocean, and called typhoons in the Western Pacific, near East Asia.

If a hurricane travels far enough, it changes its title but not its name. For example, in 2015, Hurricane Kilo became Typhoon Kilo when it bypassed Hawaii and tracked northwest toward Japan.

HURRICANE RISK MANAGEMENT: THE PERSONAL VERSION

A hurricane can wreck your home or other property, but whether it also devastates your finances is at least partly up to you.

“For most people, the biggest asset they ever own is their house,” says Ilan Noy, chair in the economics of disasters at Victoria University of Wellington’s School of Economics and Finance, in New Zealand. “If your house gets destroyed by a hurricane and you don’t have insurance, then you have lost everything.”

But don’t assume that because you have a standard homeowner’s policy, your finances are safe. Before Hurricane Iniki struck Kauai and Oahu in 1992, homeowners’ policies typically covered hurricanes, but these days, most general policies do not cover damage inflicted by floods or hurricane-strength winds. Here’s a guide to making sure you’re covered when the storm blows in.

1. Ask your agent for hurricane insurance. Mortgage companies explicitly require it, but, if you’ve paid off your mortgage or inherit your residence from someone else, it’s up to you to seek hurricane coverage, which is usually offered as a separate policy or rider. Most general homeowners’ policies cover damage by winds up to hurricane strength.

2. Do it well before you need it. When a hurricane is imminent, many insurance providers will stop providing new policies or expanding coverage.

3. Make sure your policy covers the right things. Hurricane policies only cover hurricane-strength winds, and the rain or other damage that directly ensues. In the aftermath of Hurricane Katrina, many policyholders were shocked to find that their separate hurricane policy didn’t cover flooding, says Noy. “In a lot of places in New Orleans, there was an issue whether your house was damaged by wind or by water; a lot of houses had one (policy) but not the other.” Flood insurance policies are available through the National Flood Insurance Program; call your insurance agent.

4. Make sure your policy covers full replacement. Buying the minimum insurance coverage a mortgage company requires is a bad idea, says Paul Bunda, an independent agent and former VP with Noguchi & Associates, who has worked in the industry for more than four decades. “The mortgage companies, all they’re worried about is making sure that whatever balance is owed to them is covered. If your house is worth a million bucks, and the balance on your mortgage is a hundred thousand dollars, all they will care about is the hundred grand,” Bunda explains. He adds that ensuring you have full replacement value also entails bumping up your insurance coverage as the replacement value of your house creeps up, over time.

5. Avoid a “partial loss” scenario. Having less than full replacement coverage leaves you open to a particularly unpleasant scenario. “If there’s a partial loss,” says Bunda, “then it gets ugly.” For example, if your house is valued at $500,000 but you have $250,000 in hurricane coverage, you might think that $100,000 in damage would be entirely compensated. Nope, says Bunda, “They’re going to repair 50 percent of that” $100,000 loss.

6. Keep your important papers and information in a safe location. A watertight box with crucial papers, files and documentation of the pre-hurricane state of your house and its contents is vital from a financial standpoint. Online cloud storage with digital backups of all your documents isn’t a bad idea, either.

7. If a hurricane hits, call your insurance agent. This one’s not particularly time sensitive because claims will generally be processed in order of seriousness rather than first come, first served, says Bunda. It also means that if your damage isn’t serious, you don’t have to worry that your call will displace someone else in need. After Hurricane Iniki, Bunda, who represented many clients on Oahu’s West Side, heard radio silence until the fifth day, when he got a flood of calls from folks who had sustained some damage but were waiting for the really serious cases to go first. “People in Hawaii are funny,” laughs Bunda. “They’re very considerate. Even in a hurricane.”

8. Secure a contractor, fast. After a storm’s devastation, the quicker you are off the mark, the better, says Bunda, recalling Iniki. “On Kauai, there were not enough contractors. People were waiting a year, year and a half, two years before they got somebody.”

He adds that some contractors had driven up their prices far beyond what insurance would compensate: “They were saying that a $50,000 repair was going to cost $100,000, and what are you going to do? But the insurance company will only give them 50.” The years-long period of bureaucracy, contractor gouging and waiting that followed Iniki was bad enough that some on Kauai called it the “Second Disaster.”

7 THINGS YOU SHOULD KNOW ABOUT HURRICANE-RESISTANT BUILDINGS

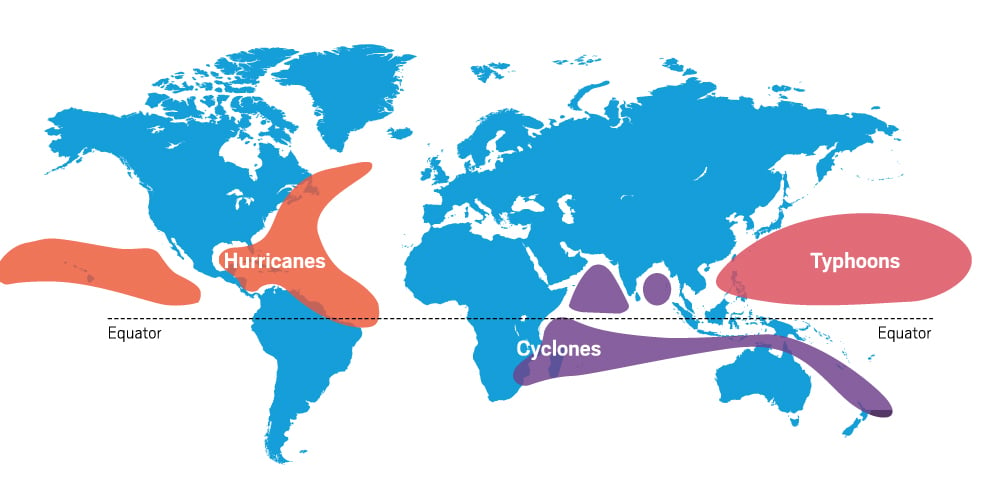

We all know about the benefits of hurricane roof clips and hurricane shutters. But Tom Sabbatelli, meteorologist and product manager for the U.S. hurricane models of the risk-management giant RMS, says there are other features of construction and location that can impact hurricane risk. “It’s interesting to see these patterns emerge as you examine claims,” says Sabbatelli.

1. Roof shape matters. Native Hawaiians were on to something when they built the steeply pitched, hipped (or hip) roofs that then inspired the hipped roofs of Territorial-Era architecture, like the Honolulu Museum of Art’s Beretania Street campus. “Hip roofs, with sloping surfaces on all four sides of a building, generally perform the best of all roof shapes because the wind loads are more evenly distributed over the building envelope,” says Sabbatelli. The roof pitch is important, too, he adds: A steeper slope is generally better.

2. Size matters. “Typically, the larger the size of the residential or commercial building, the less vulnerable it is to wind damage,” says Sabbatelli.

3. Newer is usually better. Newer construction tends to be less costly to insure for hurricanes, and there’s a reason for that. When your insurance company asks what year your house was built, it’s really asking what the building code was at the time of construction. Building codes in Hawaii have gotten stricter and more hurricane resistant over time.

4. Steel, stone and concrete trump wood. Both rock and scissors would beat paper in a hurricane scenario, since wood is both lighter (easier to blow away) and easier to break. Sabbatelli says that an example of how much difference materials make – and an exception to the “steeper is better” roof rule – are the flat roofs of the Caribbean, which are built of concrete and “often resist significant pressure and lift.” If you want to strengthen a wooden structure against hurricanes, adding metal elements like hurricane clips and shutters is a good start.

The Westin Kauai was one of the island’s biggest employers when Iniki hit. The damage was so severe that it took three years to reopen, as a Marriott resort. Photo by Nick Galante.

5. One story can be better than two. Good news for owners of bungalows and plantation- and ranch-style houses: Two-story buildings are susceptible to what Sabbatelli calls “a trickle-down effect.” That’s when damage to the roof or upper story lets in water that causes second-floor damage, then leaks down to the first floor. “That’s a pattern we saw in Florida, in the hurricanes of the 2004-2005 season,” he says.

6. Apartments and condos can be good bets, too. Taller buildings tend to be more resilient, says Sabbatelli. Living above the first floor also makes flood damage to your unit less likely. But choosing too high a floor in a multistory building comes with its own risks; wind speeds increase with elevation, leading to a higher risk of window breakage.

7. High is not necessarily mighty. Topographical elevation matters, even to single-story structures. When RMS releases its new set of U.S. hurricane risk models in 2017, Hawaii will be “the only one that considers topography,” says Sabbatelli. “We don’t consider it on the Mainland U.S. because the variations in elevation are not as severe.” In valleys, there’s an increase in maximum-wind-gust strength at higher elevations, which makes damage more likely.

A HURRICANE’S LONG-TERM EFFECTS

In the risk-management industry, major hurricanes (defined as Category 3 or above) are classified as “low-frequency, high-impact” events; they don’t come often, but, when they do, they can change everything.

Just how the Islands will be affected when the next major hurricane strikes, and for how long, is unknown. Most studies of natural disasters look at the immediate aftermath, or perhaps a year or two out, but Makena Coffman, an associate professor of urban and regional planning at UH Manoa, says that means the true long-term impacts of hurricanes and other low-frequency, high-impact events are often hidden. And, “because we don’t know, it doesn’t really sink into our long-range plans. We think, ‘The aftermath is bad, then they recover.’ But do they?”

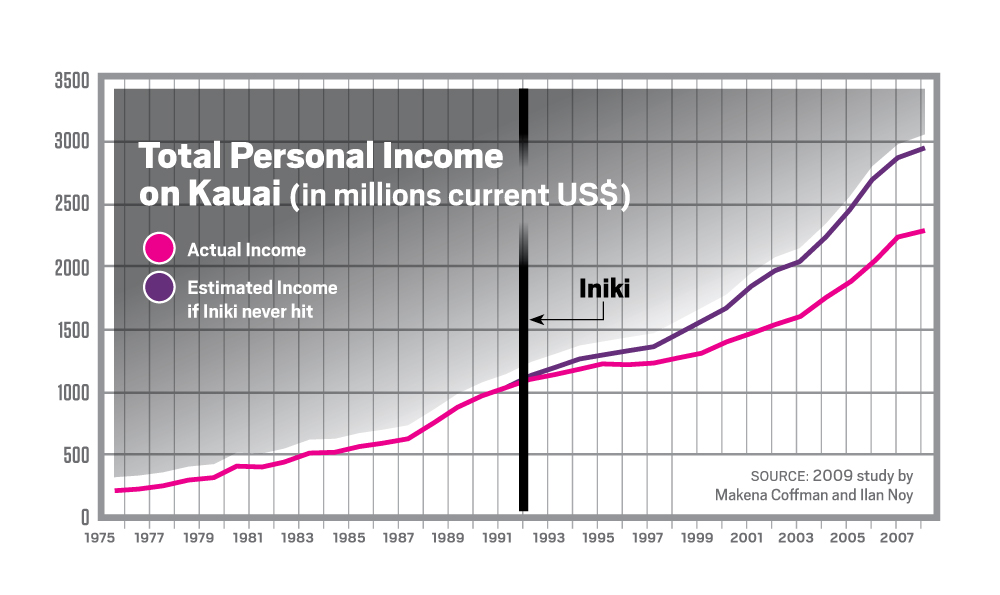

According to a study published in 2009 and authored by Coffman and Ilan Noy, an expert on the economics of natural disasters, the trajectories of places visited by a major hurricane can be forever altered. Coffman and Noy compared the economic development of Kauai after Hurricane Iniki with Maui, an island with a similar economy and pre-Iniki growth rate that had not been affected by the hurricane, and found permanent impacts to Kauai’s population and labor force.

Although per-capita income had recovered, says Coffman, the exodus from Kauai meant that Iniki “created a new equilibrium state with a functionally lower population than would have existed” without the hurricane.

In the paper, Coffman and Noy estimate that Kauai “experienced a permanent loss of about 3,000 private-sector jobs (about 12 percent of employment on the island). This amounts to about $225 million (2008 dollars) that have disappeared from the Kauai economy every year.”

Every community hit by a hurricane responds differently. More than a decade after Katrina, New Orleans is still “maybe 20 percent down (in population) from where it was before the hurricane hit,” says Noy. But New Orleans residents were able to drive to different, similar-size communities that had not been affected by the storm and, in many cases, find similar jobs. That wasn’t the case for Haiti, whose population has remained largely in place despite Hurricane Matthew’s Category 4 devastation in October 2016. People in Haiti, particularly in its capital, Port-au-Prince, “really didn’t have a place to go,” says Noy. “They can’t leave the country. And Port-au-Prince is the only urban center.” Unlike New Orleans residents, Haitians didn’t have another good option.

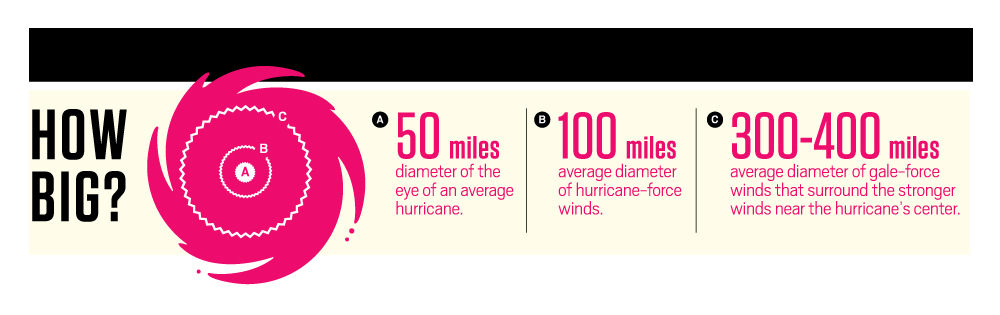

What would happen to Oahu if a major hurricane struck? The damage would clearly be enormous. With a population of about 51,000, Iniki caused $7.4 billion (2008 dollars) in damage on Kauai. Oahu’s current population is around 1 million, 20 times Kauai’s back then.

In the long term, though, Noy suspects Oahu might recover more quickly, and might not suffer the significant long-term population and labor declines that occurred on Kauai, whose central economic driver was tourism. Tourism is twice vulnerable to a natural disaster, says Noy, because a disaster damages both infrastructure and the fantasy on which tourism relies. “You often see a reduction in tourism that is not necessarily related to the nature of the damage, but rather has to do with the fact that people now associate the place with the disaster.” When Kauai’s tourism industry collapsed, says Noy, “There was no other way to make a living.”

Oahu is more economically diverse and it has the state’s only urban center. “You can always move to the Mainland,” says Noy. “But, if you want to stay in Hawaii and you want an urban kind of job, there’s not that much the other islands can offer you.”

There is also the significant military presence on Oahu, which Noy describes as a major asset to recovery that Kauai lacked. “The military will actually assist in recovery, for the emergency phase, but also after the emergency phase. Whatever you think of the military, it’s a plus that it can mobilize a lot of resources if there is a disaster.”

Although there has never been a major hurricane in a densely populated area of Hawaii, there also haven’t been densely populated areas for very long; a century ago, Honolulu’s population was about 52,000 – close to that of Kauai before Hurricane Iniki. And talk of climate change, along with recent meteorological developments, are adding to the feeling that this particular low-frequency, high-impact event may come around more often than we expect.

“(In 2015), we had a hurricane season that broke many, many records,” says Pao Shin Chu, Hawaii’s state climatologist. “Usually, we have maybe three or four tropical storms or hurricanes over the Central North Pacific (Hawaii’s meteorological region). That year, we had 14.” At one point in 2015, says Chu, “We had three Category 4 hurricanes occurring simultaneously over the Central North Pacific,” a meteorologically unprecedented event.

“The number of near-misses we’ve had recently is quite astonishing,” confirms Coffman, of UH Manoa. While no one knows for sure what effects a changing climate will have on hurricane patterns, she says, “The general trend is that climate scientists are telling us this will be happening with more frequency. And, at some point, we’ll likely cease to be lucky.”

HAWAII ISLAND AND OAHU: ISLANDS AT RISK

When talking about future hurricane impacts, weather and climate scientists and risk analysts mention two Hawaiian Islands more than any others – and neither is Kauai.

Oahu, with Hawaii’s largest concentration of people, has the most to lose from a major hurricane strike. Photo: Shutterstock.com.

The first is Hawaii Island, which state climatologist Pao Shin Chu says is “more vulnerable to hurricanes” than the other islands because of its location.

“Most hurricanes come from the Eastern North Pacific,” says Chu, which is the meteorological region southeast of the Hawaiian Island chain. And because of prevailing weather patterns, nearly all of those Eastern North Pacific-born hurricanes move in a generally northwesterly direction. The Hawaiian Islands’ northwest-to-southeast orientation means that a hurricane moving northwest is likely to hit Hawaii Island first, and perhaps lose steam as it passes over the island’s five massive volcanoes.

But, although Hawaii Island may be more likely to be struck by a hurricane, Sabbatelli, of RMS, says that if a hurricane does strike Oahu, it’s more likely to be severe. “There are two types of hurricane (tracks) that we typically see in Hawaii,” he says. The first is the kind of storm that would strike Hawaii Island, approaching from the southeast and heading toward the northwest. “But the more severe storms are like Iniki, that tend to approach from the south or southwest. Those are the ones that typically impact Oahu and Kauai,” says Sabbatelli; although those storms are not as common, “they pack more of a punch.”

Oahu also has the most to lose in human terms. The island’s high population concentration means that there’s a lot of life and property exposed per square mile. Bunda, the insurance agent who serviced many claims from Iniki, hates to think of a hit on Honolulu. “Honolulu is so concentrated,” he says. “Kauai wasn’t. When it got hit, it was (the population centers of) Princeville and the south shore that had all the damage. If you look at Honolulu – oh, my God.”

How can you tell these two types of hurricanes apart? Those that are likelier to travel northwest and hit Hawaii Island are born in the Eastern North Pacific region, near Central America, and are named from a rotating annual list that includes Western names, including many that are Latin-influenced (including Iselle, Julio and Hermine).

But, watch out if there’s a hurricane with a Hawaiian name heading for Hawaii, like Iwa or Iniki; that means it was formed closer to home, and named from the Central North Pacific Hurricane Center’s rotating list of Hawaiian and Polynesian names. Although state meteorologist Chu cautions that strong hurricanes can originate anywhere, Sabbatelli, of RMS, confirms that generally, “the more severe storms, like Iniki, tend to form in the Central Pacific.”