BOSS Survey of

350 Local Business Leaders

Most say their companies still performed well in the seventh year of this economic expansion. But asked about the near future, their collective enthusiasm is down.

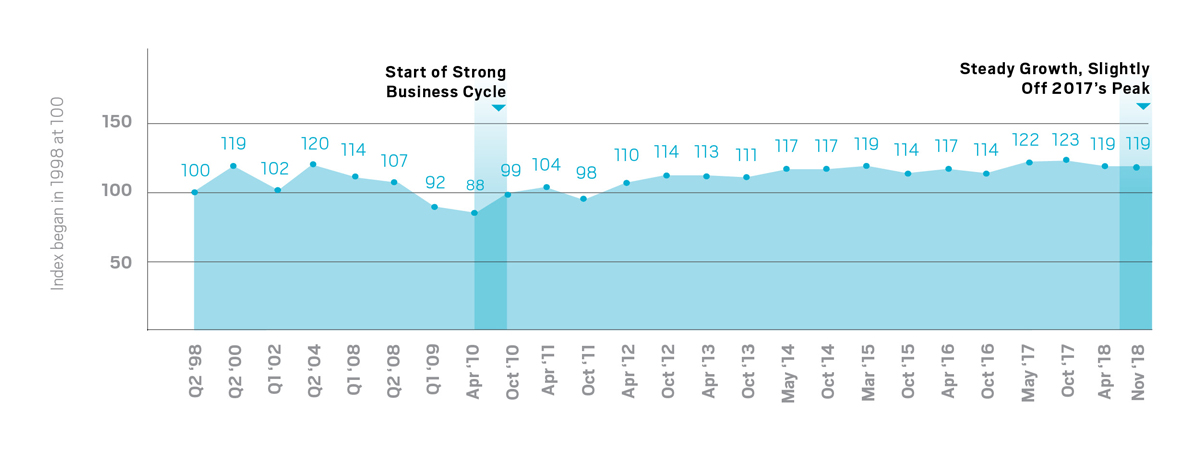

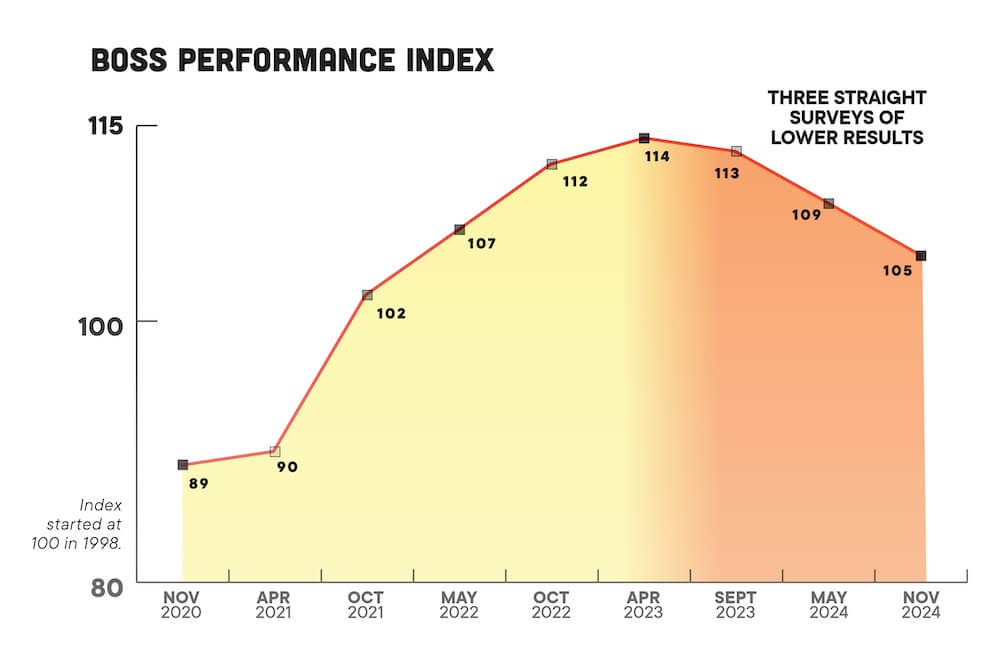

The BOSS Performance Index

The Performance Index measures changes in employment, gross revenues and profit among the businesses surveyed and compares those results to similar surveys over the past two decades.

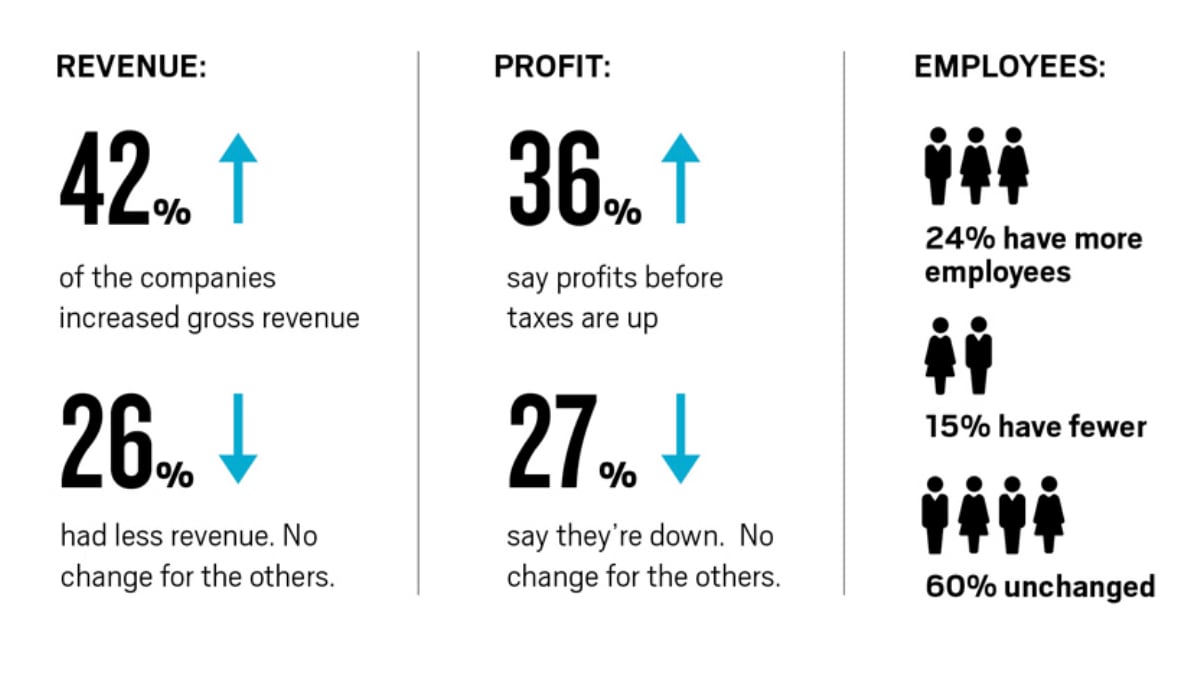

Highlights

The Performance Index is based on the past year of revenue, staffing and profit at the 350 companies surveyed. Here are highlights:

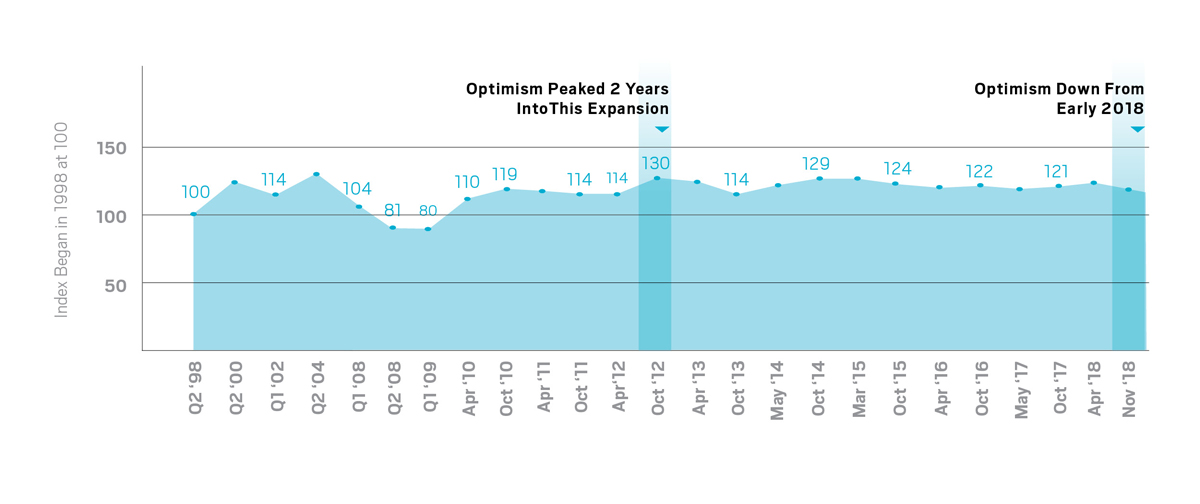

The Boss Optimism Index

Highlights

The Optimism Index is based on how the surveyed business leaders feel about the economy in the coming year: Will it improve, stay the same or get worse?

Spring 2018 BOSS

- ► Last spring, 38% of the business leaders surveyed thought the local economy would improve in the coming year. Other questions in that survey indicated the optimism was at least partly driven by changes in federal tax laws at the end of 2017.

- ► Back then, only 13% of the business leaders thought the local economy would get worse.

Fall 2018 BOSS

- ► Six months later, only 27% of the business leaders surveyed felt the economy will improve in the coming year – the lowest percentage of optimistic responses in all the BOSS surveys this decade.

- ► 18% of business leaders surveyed in the fall believed the economy would get worse in the coming year.

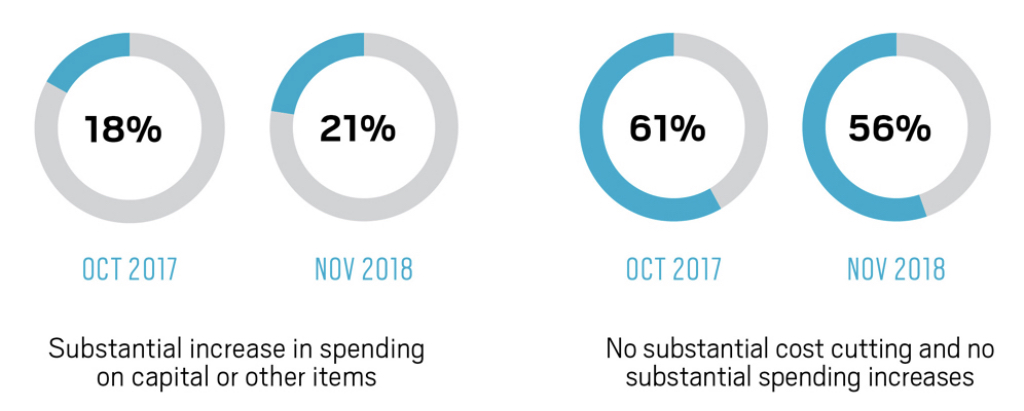

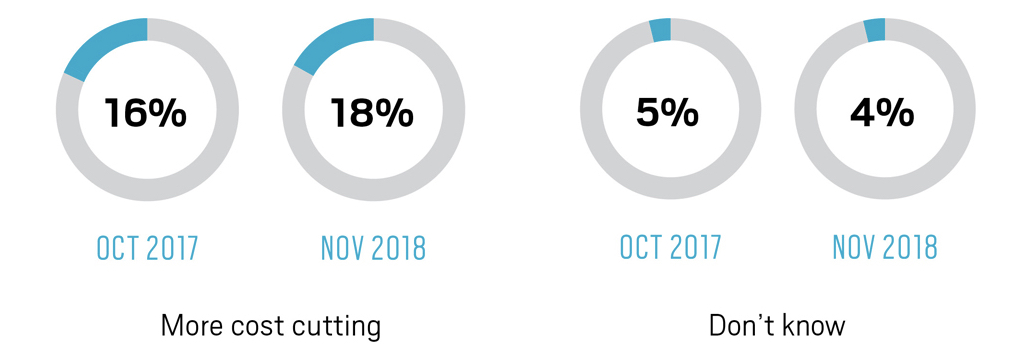

Will Your Company Spend More?

To further probe how business leaders feel about the future of the local economy, the BOSS survey asked which of these three statements best describes their company’s plans in the coming year.

![]()

Note: Percentages do not always add to 100 due to rounding.

More BOSS Each Month!

Hawaii Business will publish further results from the BOSS survey of 350 local business leaders in each issue.

━━

METHODOLOGY: The BOSS survey is conducted twice a year for Hawaii Business by the research division of the Anthology Marketing Group.

This latest survey was conducted using a list of Hawaii companies purchased from Equifax Polk Business Directory as well as Hawaii Business’ Top 250 list and classified Yellow Pages listings. The sample of companies was stratified based on each company’s number of employees; the data were then weighted to reflect the proper proportions of each strata in the Hawaii economy based on data from the state Department of Labor. Leaders on all major Islands were surveyed in proportion to their share of the local economy.

A total of 136 leaders were surveyed who describe their companies as deriving a significant proportion of their revenues from the visitor sector.

A total of 350 random interviews on all the major islands were conducted Sept. 19, 2018 to Nov. 1, 2018. A sample of this size (n=350) has a margin of error of plus or minus 5.24 percentage points with a 95 percent level of confidence.