BOSS Survey of 404 Local Executives Shows Optimism Crushed

Poll conducted March 30 to April 17 reveals pessimism unmatched among Hawai‘i’s business leaders since the depths of the Great Recession. First quarter numbers on revenue, employment and profit hint at second quarter devastation to come.

Hawaii Business Magazine and the research team at Anthology Marketing Group collaborated on this scientific poll that we call the BOSS Survey. This is Part I in a five-part series of results. See the other parts later this week and Monday at hawaiibusiness.com. Learn the methodology for this survey at the bottom of this report.

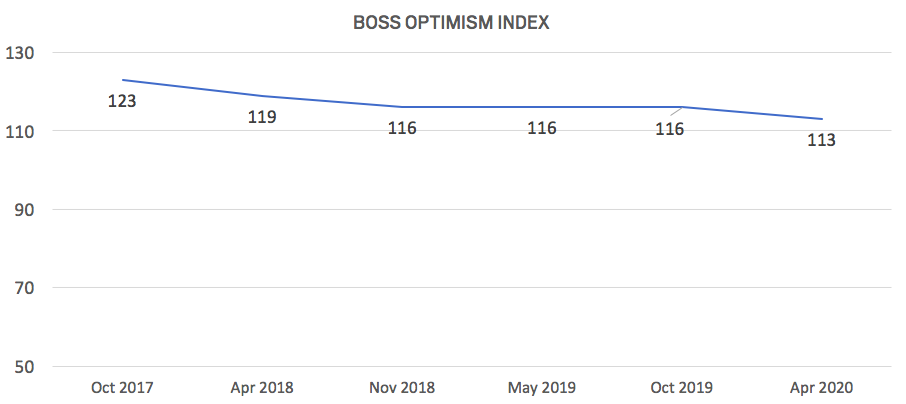

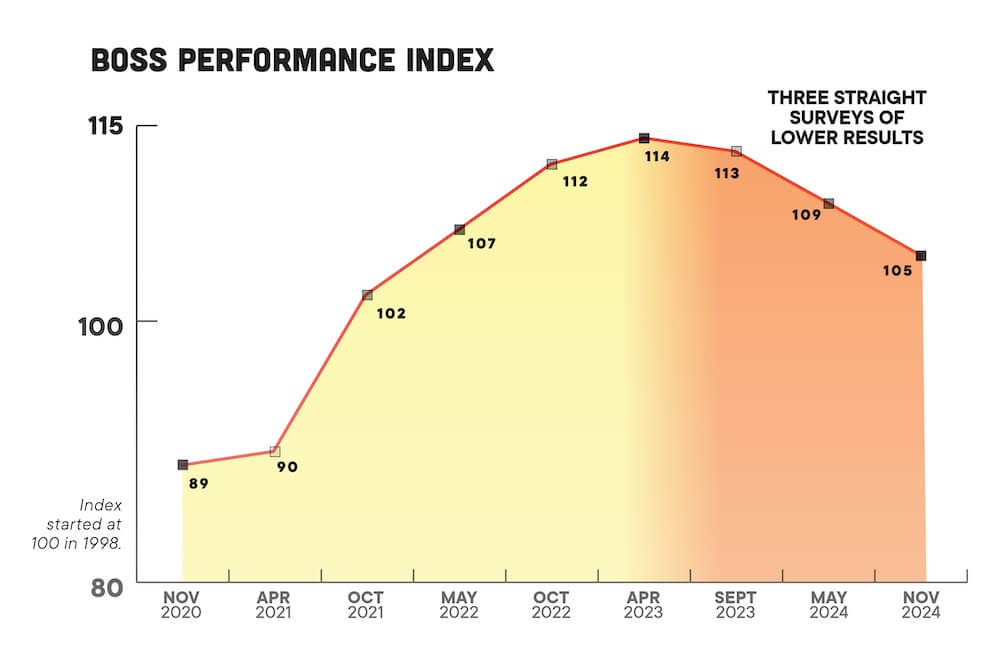

The BOSS Optimism Index is based on what business leaders think about the economic near-future of Hawai‘i: Will the overall local economy get better, worse or stay the same in the coming year? In 23 years of BOSS Surveys, this is only the third time the index has fallen below 100. Both previous times were in the depths of the Great Recession.

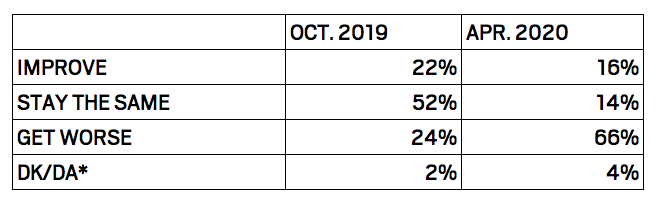

Two-thirds (66%) of the business leaders surveyed believe the economy will get worse in the coming year. We compared the results of this question about the local economy to the previous BOSS Survey, conducted in October 2019.

Interestingly, retailers were more optimistic regarding the state’s one-year economic outlook (25% said things will improve) than those outside of retail (14% said things will improve).

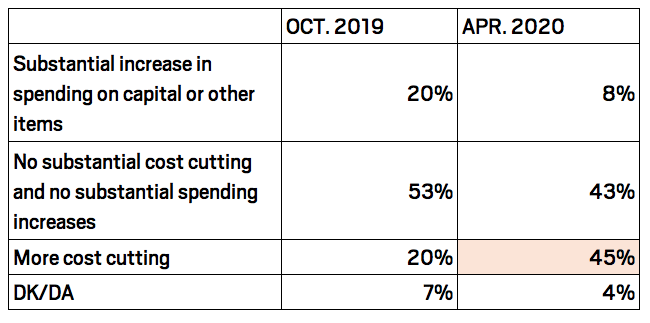

What Does Your Company Plan to Do?

To further probe the perception of the local economic climate, business representatives were asked which of these three statements best describes their companies’ spending plans for the coming year.

There was no significant difference in the overall answers when considering company size based on number of employees.

There was no significant difference in the overall answers when considering company size based on number of employees.

Historical Highs and Lows

The BOSS Optimism Index began in 1998 at 100. It has rarely dipped below that level, reflecting the generally upbeat feelings of local business leaders.

- Its peaks were in the second quarter of 2004 (134) and Oct 2012 (130).

- It bottomed out during the Great Recession, in the second quarter of 2008 (81) and the first quarter of 2009 (80).

In the past, local business pessimism has faded quickly after economic crises:

- The terrorist attacks on Sept. 11, 2001, led to a tourism downturn, but the Optimism Index in the first quarter of 2002 was a healthy 114. In the second quarter it was 120.

- The Great Recession ended in the U.S. in June 2009; the Optimism Index was already at 110 by April 2010.

We plan to conduct another BOSS Survey in the fall; we will report the results, including the Optimism Index, as soon as we can.

Revenue, Profit and Employment

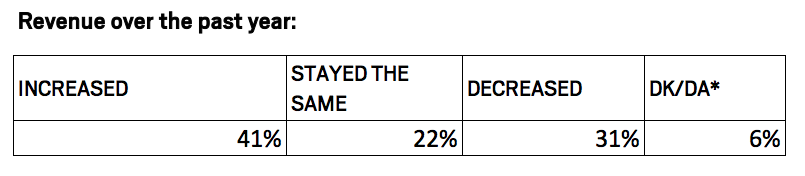

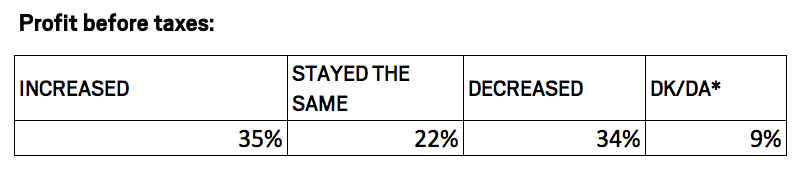

The Performance Index is based on revenue, profit and employment over the past year at the 404 businesses surveyed. Did those performance indicators go up, down or stay the same?

As you can see in the chart, the index only fell three points from the previous survey – an indication that actual business effects of the COVID-19 crisis were barely felt by the time the survey was conducted March 30 to April 17. The full effect on companies’ revenue, profit and employment should be more obvious when we conduct the next BOSS Survey in six months.

This lag in the BOSS Performance Index can be seen in past results. For instance, the survey completed in the first quarter of 2008 – after the Great Recession had already begun in December 2007 – showed the performance index at a healthy 114. It fell to 92 in the next survey (the first quarter of 2009) and bottomed out at 88 in the first quarter of 2010. And though performance results were horrible in that first quarter 2010 survey, optimism had already staged a big comeback, as noted above.

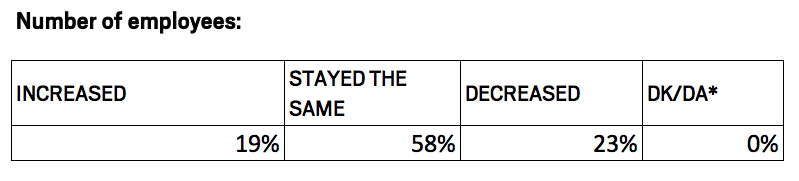

Here are the results from the 404 companies polled in the latest BOSS Survey.

Read other parts of this BOSS Survey of 404 local business executives

Part II: Hawai‘i companies explain how they scrambled to cope with COVID-19.

Part III: Business leaders foresee no quick recovery. Plus what they think of governmentʻs response.

Part IV: BOSS Mini Survey of 88 local retail executives asks about revenue, profit and staffing; e-commerce and competition.

BOSS Methodology

BOSS stands for Business Outlook and Sentiment Survey. The BOSS Survey was conducted by the research team at the Anthology Marketing Group. They created their sample using a listing of local companies purchased from a third-party business sample provider as well as Hawaii Business Magazine’s Top 250 list and classified yellow pages listings.

The sample of companies was stratified based on number of employees. Small businesses were divided into two subgroups. Businesses with two to nine employees were designated as “very small” and those with 10 to 49 employees were designated as “small.” Medium-size companies were those with 50 to 99 employees while companies with 100 or more employees were classified as “large.” The goal was to complete interviews with executives heading 50 businesses in each of the large and medium sectors, with 300 interviews falling into the two small business categories.

A secondary goal was to complete interviews with people at 100 businesses who describe their companies as deriving a relatively significant proportion of their revenues from the retail industry. A total of 88 retail companies were surveyed in this segment.

A total of 404 random interviews on all the major islands were conducted from March 30 to April 17, 2020. The data was weighted to reflect the proper proportions of each company segment based on number of employees as reported by the Hawai‘i Department of Labor. A sample of this size has a margin of error of plus or minus 5.0 percentage points with a 95% level of confidence.