Hawaii’s Most Profitable Companies 2012

A look at what fed or ate away at the bottom line

Well-run and innovative companies are usually profitable, while mismanaged and stagnant companies often lose money and go out of business. That’s easy to understand. But equally important are forces outside a company’s control, including energy prices, unemployment and interest rates. How an organization responds to these outside forces makes a huge impact on the bottom line. For this report on Hawaii’s most profitable companies, we dove into financial statements and talked with more than a dozen business leaders to understand how their companies responded to their unique situations, and how that affected their bottom lines.

| Profit Rank | Top 250 Rank | Company Name | Net Income/Loss (2011) | Profit as % of revenue |

|---|---|---|---|---|

| 1 | 11 | First Hawaiian Bank | $209,030,000 | 30% |

| 2 | 12 | Bank of Hawaii Corp. | $160,000,000 | 25% |

| 3 | 1 | Hawaiian Electric Industries Inc. | $138,230,000 | 4% |

| 4 | 2 | Hawaii Medical Service Association (HMSA) | $44,960,000 | 2% |

| 5 | 7 | Hawaii Pacific Health | $44,229,585 | 5% |

| 6 | 33 | Central Pacific Financial Corp. | $42,377,000 | 24% |

| 7 | 3 | Alexander & Baldwin Inc. | $34,200,000 | 2% |

| 8 | 8 | Queen‚aôs Medical Center | $32,725,000 | 5% |

| 9 | 18 | Hawaiian Telcom | $26,155,000 | 7% |

| 10 | 98 | Xerox Hawaii* | $24,000,000 | 34% |

| 11 | 87 | Hale Koa Hotel* | $17,989,600 | 23% |

| 12 | 36 | First Insurance Co. of Hawaii Ltd. | $14,916,000 | 8% |

| 13 | 95 | Zephyr Insurance Co. Inc. | $13,000,000 | 72% |

| 14 | 102 | Territorial Savings Bank | $12,789,000 | 19% |

| 15 | 124 | Stoebner Holdings Inc.* | $12,428,024 | 24% |

| 16 | 50 | Board of Water Supply | $12,394,000 | 7% |

| 17 | 111 | HawaiiUSA Federal Credit Union | $11,600,000 | 19% |

| 18 | 38 | Kauai Island Utility Cooperative* | $9,656,872 | 5% |

| 19 | 65 | Island Insurance Company, Ltd. | $9,347,055 | 8% |

| 20 | 160 | Hawaii Employers‚aô Mutual Insurance Co. | $8,219,716 | 24% |

| 21 | University Health Alliance (UHA) | $7,269,927 | 5% | |

| 22 | 76 | Pacific Guardian Life Insurance | $6,986,901 | 8% |

| 23 | 199 | Wells Fargo Home Mortgage of Hawaii LLC* | $6,545,821 | 30% |

| 24 | 167 | Windward Auto Sales Inc.* | $6,082,828 | 20% |

| 25 | 128 | Hawaii State Federal Credit Union | $5,365,634 | 11% |

| 26 | 6 | Kaiser Permanente Hawaii | $4,919,790 | 0.5% |

| 27 | 92 | Farmers Insurance Hawaii Inc.* | $4,287,946 | 6% |

| 28 | 213 | HawaiianTel Federal Credit Union | $4,266,172 | 20% |

| 29 | 136 | Chaminade University | $4,215,000 | 10% |

| 30 | 183 | Catholic Charities Hawaii* | $4,210,000 | 15% |

| 31 | 228 | HFS Federal Credit Union | $3,623,230 | 16% |

| 32 | 215 | University of Hawaii Federal Credit Union | $3,014,135 | 18% |

| 33 | 172 | Hawaii Foodbank Inc.* | $2,987,766 | 10% |

| 34 | 208 | Hawaiian Insurance And Guaranty Co. Ltd. | $1,791,341 | 48% |

| 35 | 158 | Aloha Pacific Federal Credit Union | $1,762,194 | 8% |

| 36 | 226 | Cyanotech Corp.* | $1,730,000 | 10% |

| 37 | 195 | Triple F Holdings, LLC* | $1,500,000 | 6% |

| 38 | 139 | Pharmacare Hawaii Inc.* | $1,400,000 | 3% |

| 39 | 237 | Kaikor Construction Co. Inc.* | $1,390,866 | 11% |

| 40 | Royal State National Insurance | $1,327,430 | 19% | |

| 41 | 127 | JBG Corp.* | $1,200,000 | 2% |

| 42 | 225 | Blood Bank of Hawaii* | $1,098,065 | 6% |

| 43 | 182 | Mid-Pacific Institute* | $1,064,000 | 4% |

| 44 | 119 | DTRIC | $930,968 | 3% |

| 45 | 178 | Hawaii National Bank | $879,000 | 3% |

| 46 | 232 | Hawaiian Islands Freight Association* | $846,510.41 | 6% |

| 47 | 149 | Hawaii Auto Group – Cadillac, GMC, Buick, VW of Honolulu* | $600,000 | 2% |

| 48 | 236 | S&M Sakamoto, Inc.* | $588,000 | 4% |

| 49 | 153 | Contract Furnishers of Hawaii Inc. (dba Office Pavilion)* | $530,209 | 1% |

| 50 | 113 | Wasa Electrical Service Inc.* | $342,000 | 1% |

| 51 | 185 | Castle Group, Inc.* | $261,000 | 1% |

| 52 | 235 | Continental Mechanical of the Pacific* | $193,000 | 1% |

| 53 | 69 | Coastal Construction Co. Inc.* | $190,000 | 0.2% |

| 54 | 223 | ML Macadamia Orchards* | $90,000 | 1% |

| 55 | 22 | Kalaeloa Partners L.P.* | $38,756 | 0.01% |

| 56 | 170 | Mina Pharmacy* | -$80,000 | -0.3% |

| 57 | 147 | Barnwell Industries Inc. | -$109,000 | -0.3% |

| 58 | 214 | Kamaaina Care Inc. (dba Kamaaina Kids)* | -$276,000 | -1% |

| 59 | 181 | Kahi Mohala Hospital* | -$550,000 | -2% |

| 60 | 174 | Kahala Nui* | -$942,025 | -3% |

| 61 | Dongbu Insurance Co. | -$1,467,317 | -6% | |

| 62 | 231 | Maui Land & Pineapple Co. | -$1,597,000 | -5% |

| 63 | 210 | Finance Factors Ltd. | -$1,986,000 | -10% |

| 64 | 4 | Hawaiian Airlines Inc. | -$2,649,000 | -0.2% |

| 65 | 227 | Parker Ranch Foundation Trust* | -$3,000,000 | -18% |

| 66 | 46 | Hawaii Medical Assurance Association (HMAA) | -$4,200,000 | -3% |

| 67 | 30 | AlohaCare | -$4,273,656 | -2% |

| 68 | 24 | Forest City Hawaii* | -$11,000,000 | -4% |

| 69 | 159 | Hawaii Community Foundation* | -$12,630,000 | -37% |

| 70 | 15 | Hawaii Health Systems Corp. | -$111,809,342 | -23% |

| 71 | 5 | University of Hawaii | -$132,736,000 | -10% |

Fuel Prices

Rising fuel costs in 2011 were a big drain on many local businesses, but, for some Top 250 companies, when fuel prices went up, profits did not go down.

For example, Hawaiian Electric Industries’ utilities generate most of their power by burning petroleum, but, as CFO Jim Ajello asserts, “Fuel costs do not affect profitability at our company whatsoever.” That’s because the conglomerate’s electric utilities on Oahu, Maui and Hawaii Island are able to pass increased fuel costs along to customers. Indeed, HEI’s net income soared to $138 million in 2011. That’s a $24 million increase, 96 percent of which came from its electric utilities.

About $20 million of that increase was due to rate increases at its Oahu utility, Hawaiian Electric Co., which were unrelated to fuel costs. That helped push HEI’s profit up from 7.8 percent of revenue to 9.2 percent in 2011. Moreover, most of that was paid in dividends. When you add in stock appreciation, HEI gave investors a total return of more than 21 percent in 2011.

Just as the increase in oil prices did not hurt HEI, it had little impact on Matson Navigation, which is now a separate company, but last year was a subsidiary of Alexander & Baldwin. Instead of having to absorb higher fuel costs, Matson imposed $73 million in fuel surcharges on its customers in 2011. Although the shipping company’s net income fell by $74 million from 2010, much of that was due to what it called “lower yields” on its China routes.

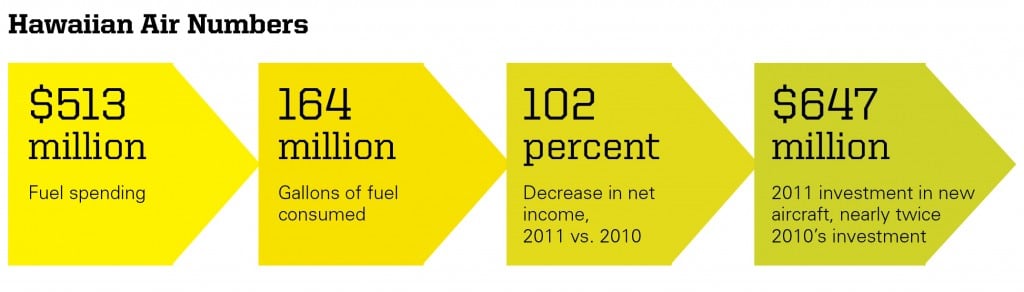

Even at Hawaiian Airlines, where fuel expenses exceeded wages and benefits in 2009 as the company’s largest single cost, the relationship between the price of fuel and profitability isn’t a straight line. CFO Scott Topping points out that HAL’s expansion has also increased fuel expenses. “Some of that was due to higher fuel price, but some was due to higher volume. You’d have to parcel that out to do a meaningful analysis.”

Hawaiian Air Numbers

Interest Rates

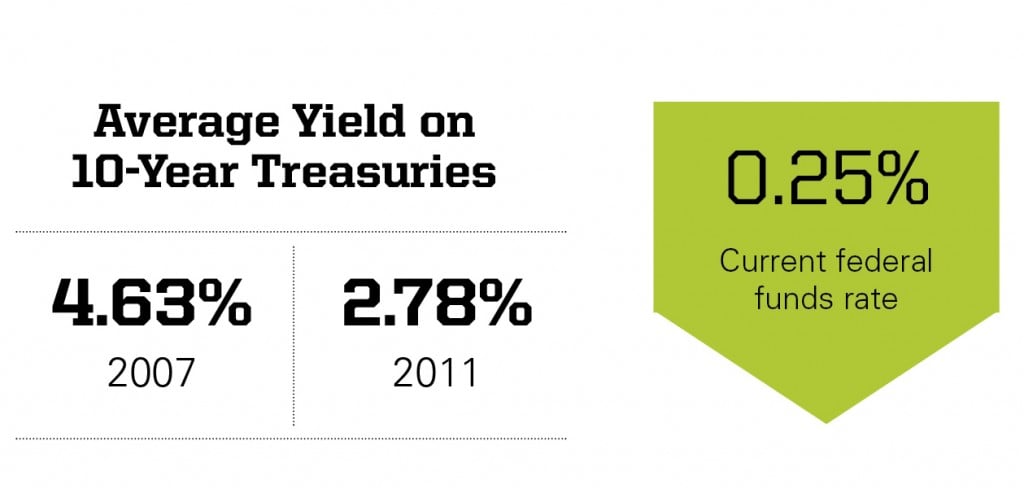

If you recently bought a home or refinanced your mortgage, you’ve benefited from historically low interest rates. But many financial institutions have been hurt by low rates.

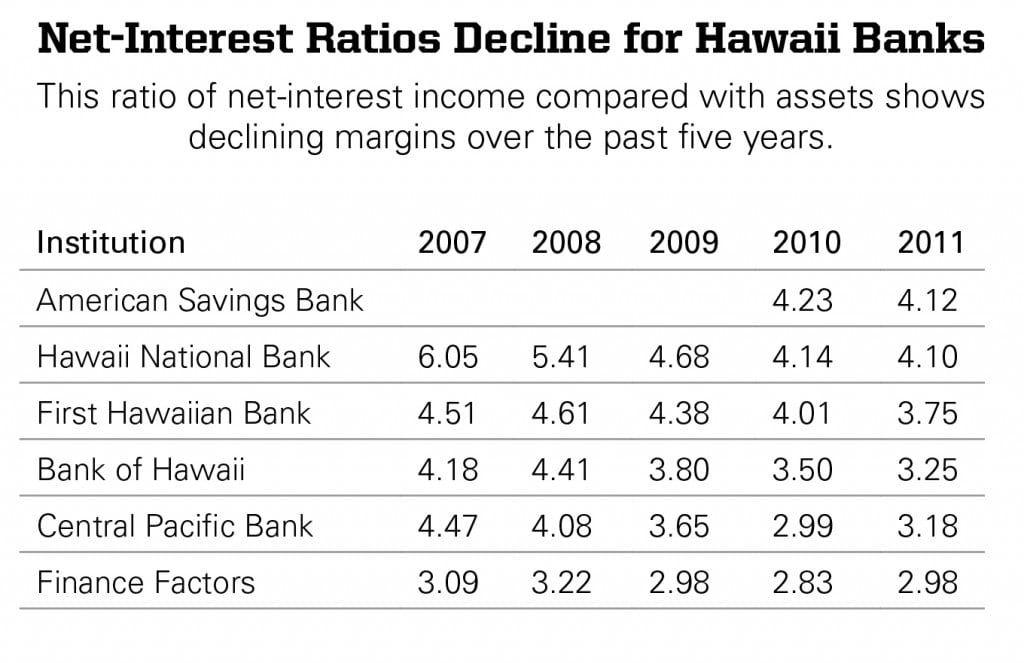

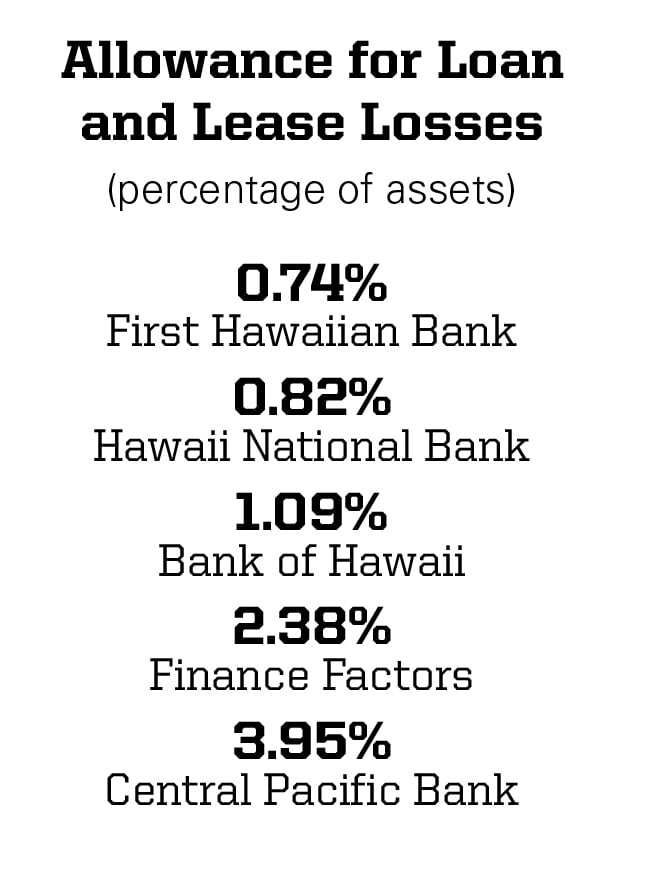

The rates that banks can charge borrowers are closely tied to the federal funds rate, so a low rate squeezes profits. The net-interest margins of Hawaii’s banks – the difference between the rate banks charge borrowers and the interest they pay depositors – is a critical measure of profitability, and it’s been steadily shrinking as interest rates fall.

With interest rates so low, banks have to be strategic to maintain profits. “As the Fed keeps ratcheting down rates, the net-interest margin keeps getting compressed,” says First Hawaiian Bank CEO Bob Harrison. “We’ve been able to make that up by growing the balance sheet – making more loans, having more deposits. So, while the margins have gone down, our returns have stayed the same.”

The effects of net-margin compression are even more pronounced for small, community banks, says Robert Nobriga, CFO of Hawaii National Bank. “Unlike some larger banks, we don’t have much fee-based income, like wealth management or credit-card processing, that can buttress some of that loss.” At the same time, he points out, there’s a floor to how far banks can cut expenses without affecting basic operations. As a privately held bank, Nobriga says, Hawaii National Bank has made the strategic decision to sacrifice short-term profits so that it can continue to invest in technology and hold on to staff.

Nobriga also points out that not all financial institutions are affected by low rates the same way. For example, banks that make a lot of commercial loans are considered “asset-sensitive.” That’s because these loans are usually short term and adjust more quickly to rate changes than the interest paid to depositors. In contrast, “liability-sensitive” financial institutions – including banks that hold a lot of long-term home mortgages – are able to lower the interest they pay depositors more quickly than clients can refinance their homes. “That’s why savings-and-loan-type banks, like Territorial Savings Bank and American Savings Bank, have maintained their margins a little better,” Nobriga says.

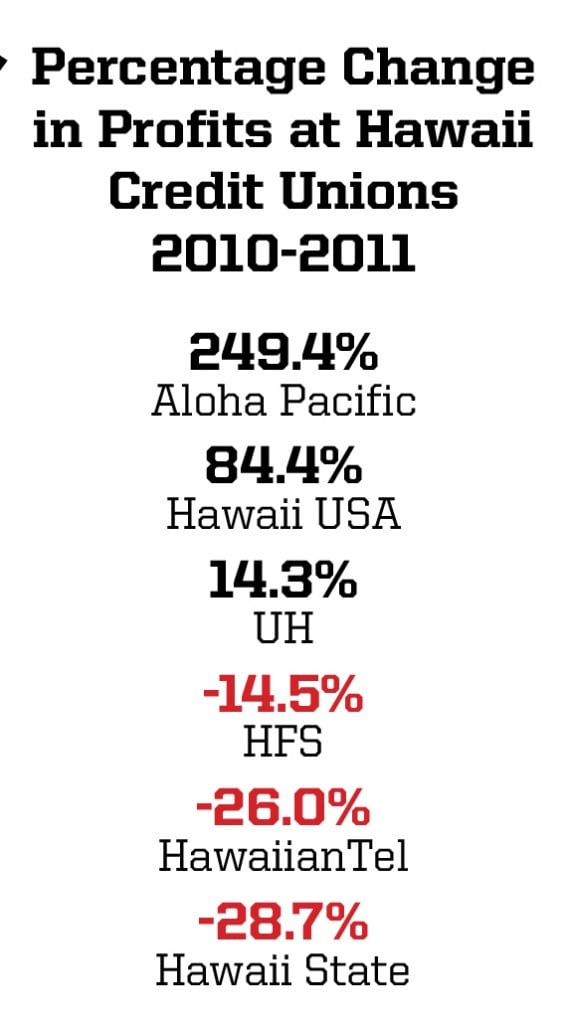

Credit unions have also scrambled to adjust to low interest rates. Aloha Pacific FCU, one of the few financial institutions in town that boosted its profit last year, increased its loan portfolio 16 percent in 2011, while simultaneously shrinking its investment portfolio by 22.7 percent. Most of this increase was in relatively high-interest home loans. In fact, Aloha Pacific opened a branch office in Las Vegas, largely to take advantage of the higher mortgage rates it’s able to charge there. In addition, the credit union has lowered the interest rates it pays member depositors. As a consequence, Aloha Pacific managed to raise its net-interest margin each of the past three years.

Low rates don’t just affect the profits of financial institutions. Organizations that depend on fixed-income investments have also felt the bite. For example, as of June 30, 2011, Kamehameha Schools had nearly $300 million parked in fixed-income investments, earning just 2.1 percent. Most conservative investors, such as trusts, nonprofits and pension funds, were forced to accept these anemic returns to hedge against uncertain times.

Average Yield on 10-Year Treasuries

Net-Interest Ratios Decline for Hawaii Banks

This ratio of net-interest income compared with assets shows declining margins over the past five years.

Net-Interest Income

$183 Million: Bank of Hawaii

$167 Million: First Hawaiian Bank

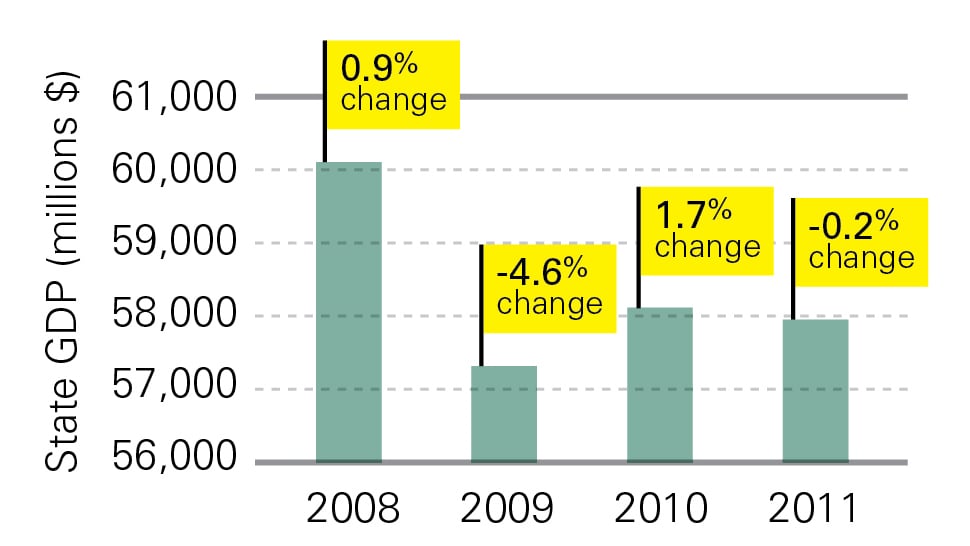

Weak Economy

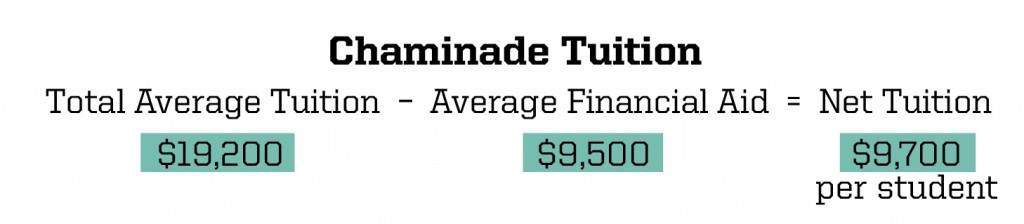

Interestingly, universities such as Chaminade have partly benefited from grim employment numbers. Bro. Bernard Ploeger, president of the university, points out that enrollment has increased in all of the school’s programs. “I think the weak economy has made people think, ‘This is a time to get further credentials,’ ” he says.

In addition to more evening and online admissions, the school has seen record enrollment for its graduate programs. It has also created a new, 75-student nursing program. Perhaps most important, the school has managed to retain more of its students year over year.

“During our first 10 years, we’ve been at about 65 percent first- to second-year retention,” says Ploeger. “For the past two years, that number has moved up to about 75 percent. With something like 800 students that are candidates for moving up, that can be an extra 80 students a year. That’s equivalent to creating another nursing program.”

The University of Hawaii system raised tuition and fees by nearly 7 percent from 2010 to 2011, yet enrollment also grew, probably because of the weak economy. Unfortunately, even with the increases, tuition doesn’t cover all of UH’s expenses. In fiscal 2011, the state appropriated more than $359 million for UH operations and still needed to transfer another $164 million to address the university’s shortfall.

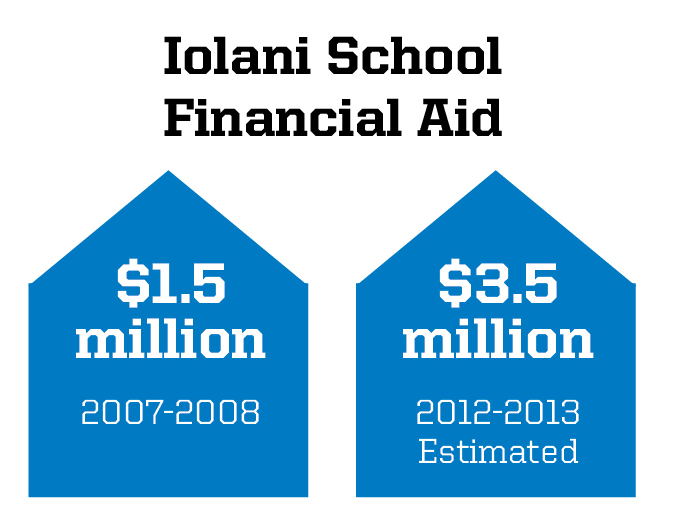

Of course, for educational institutions, the flip side to increased enrollment is the growing cost of financial aid. That’s because fewer families can afford full tuition. Even some of Hawaii’s wealthiest private schools feel the pinch. At Iolani School, the average financial aid package now covers about half the tuition. “Relative to our budget,” says outgoing headmaster Val Iwashita, “financial aid went from 8 percent to over 20 percent in the last five years.”

Iwashita notes that Iolani is lucky to have a large endowment that allows the school to offer so much financial aid. One of the few bright spots in the economy has been last year’s rebound in the stock market, which benefited the endowments of schools like Punahou, Iolani and Kamehameha.

These schools also benefit from a conservative approach to spending. Punahou, for example, won’t take on long-term debt. Its rules also limit spending to 4.5 percent of the endowment averaged over the previous five years. School president James Scott points out that this levels out the effects of swings in the economy. “So, when our endowment went down about 20 percent in 2008, it wasn’t a dramatic hit on our operating budget.”

The ongoing high unemployment rate has also impacted the state’s hospitals, largely by changing the payer mix. “As more people lose their jobs,” says Queen’s CFO Rick Keene, “they may be on Medicare or Medicaid or uninsured as opposed to being on HMSA or another big carrier.” That often means lower reimbursements or no payment at all for the hospital.

Keene points out that the operating margin for Queen’s was only about 1 percent in 2011, so even modest swings in revenue have a big effect on the bottom line, especially with a budget of more than $658 million. “We can be within 1 percent of our budgets on both the expense and revenue sides and still have potentially a 30-percent change in our operating income,” he says.

Unemployment has had an even more pronounced effect on income at the Hawaii Health Systems Corp., which serves as the state’s safety net for healthcare. “That means we provide a considerable amount of uncompensated care,” says CEO Bruce Anderson. He also notes that a high percentage of HHSC’s revenue comes from Medicaid/Medicare reimbursements, which have been declining. “We’re looking at losing over $10 million in reimbursements over the next year,” Anderson says. “Medicare is being reduced by 3 percent nationwide. That will pose additional challenges for us.”

Unemployment also affected the bottom line of the state’s insurance companies. That’s because workers’ compensation premiums are based on payroll. As companies reduced their workforces, they paid lower premiums. Similarly, business-insurance premiums are a function of a company’s gross revenues; declining or stagnant revenues mean lower premiums for the insurance companies.

Jeff Shonka, CFO of First Insurance Co. of Hawaii, explains, “The single biggest reason for the decline in revenues since 2006 has been the continued drop in workers’ compensation rates.” Today, those rates are half what they were in 2006. That’s great for business owners, but it has played havoc with the insurance companies’ revenues. For FICOH, gross written premiums fell from a high of $206 million in 2007 to $176 million in 2009 before rising slightly in both 2010 and 2011 to again reach $186 million.

Only investment income has kept Hawaii’s insurance industry in the black. Although most of Hawaii’s property and casualty companies made money on their investments, all but three – Island Insurance, Zephyr, and Hawaiian Insurance and Guaranty – had underwriting losses for 2011.

The Recession and its Aftermath

Chaminade Tuition

Iolani School Financial Aid

Hawaii Health Systems Corp.

$247 million State appropriations to HHSC over the past three years

$56 million Expected additional cost of the Patient Protection and Affordable Healthcare Act (“Obamacare”) to HHSC over 10 years

$17.9 million Net investment gain in 2011 for First Insurance Co. of Hawaii

War

Military deployments not only disrupt the lives of the families directly involved, they have repercussions throughout the local economy and for local organizations. The surge in Afghanistan in 2009 and 2010 drastically reduced Chaminade’s enrollment in evening and online programs, which have traditionally attracted a lot of military personnel. Now that those deployments have eased, enrollment is rebounding.

“Prior to 9/11, we taught over 27,000 credit hours in that area,” says Ploeger. “That dropped to as low as 19,000 hours. But it’s been growing back at something like 8 percent a year for each of the past two years.” The resulting increase in enrollment has been a boon to Chaminade’s revenue, 60 percent of which comes from tuition.

Turnarounds

A few Hawaii companies returned to profitability in 2011 after a long period in the red. Those turnarounds offer a distinct perspective on the ways companies earn and account for profits.

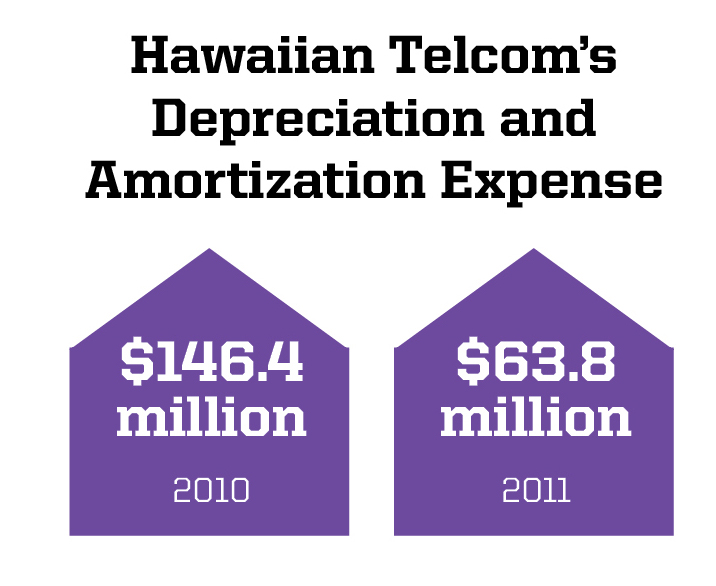

For example, Hawaiian Telcom’s net income of $26.3 million in 2011 only hints at the numbers underlying its return to profitability. Case in point: Hawaiian Telcom was able to revalue its assets while in bankruptcy, which led to dramatically lower depreciation expenses on its income statement. Of course, lower expenses mean higher net income.

But the real measure of the company’s turnaround, says CFO Robert Reich, is its healthy cash flow. In 2011, Hawaiian Telcom’s first full year out of bankruptcy, the company generated $79.2 million in net cash from operations. That allowed the company to invest $78 million in capital expenditures – technology and products for the future – yet still maintain a healthy $82 million in cash on the books.

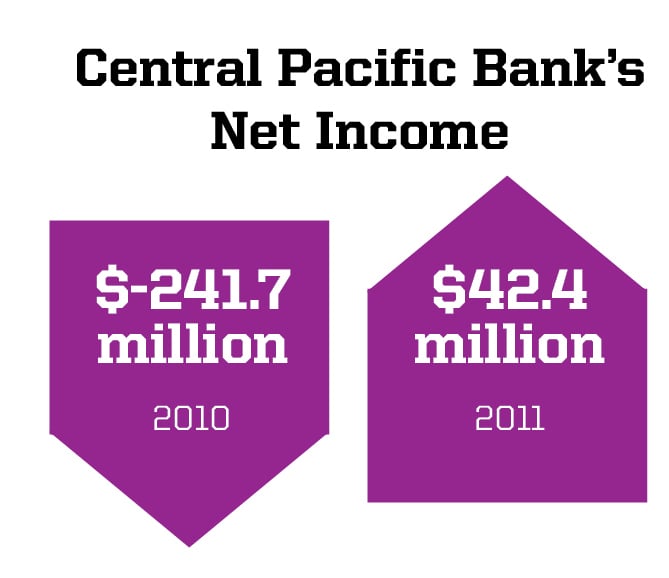

Central Pacific Bank also returned to profitability in 2011, mostly because of improving asset quality. “We’ve made incredible progress on our nonperforming assets,” says CEO John Dean. “In two years, they’ve gone from a peak of around $500 million down to about $195 million.” Banks are required to maintain an allowance for expected loan and lease losses, and Dean points out that CPB’s nonperforming assets are still high compared to other institutions.

Nevertheless, higher asset quality definitely showed up on the bottom line, as CPB was able to release more than $40 million from its loan-loss reserves.

Hawaiian Telcom’s Depreciation and Amortization Expense

Central Pacific Bank’s Net Income

Diversification and Specialization

One of the recurring themes in local business recently is how some of Hawaii’s most profitable companies diversified their sources of revenue. The decision to invest in innovation and new programs – choices often made years earlier – is frequently the difference between profit and loss today: Chaminade University invests in nursing and online education, programs that put the school in the black. Aloha Pacific Federal Credit Union, in addition to its daring excursion to Las Vegas, earned nearly $2 million in commercial real estate leases.

One of the recurring themes in local business recently is how some of Hawaii’s most profitable companies diversified their sources of revenue. The decision to invest in innovation and new programs – choices often made years earlier – is frequently the difference between profit and loss today: Chaminade University invests in nursing and online education, programs that put the school in the black. Aloha Pacific Federal Credit Union, in addition to its daring excursion to Las Vegas, earned nearly $2 million in commercial real estate leases.

Even some of the most financially challenged organizations in the state have embraced diversification. The Hawaii Health Systems Corp., despite deficits that will likely always require substantial state support, is six months into the implementation of a system-wide electronic medical-record system that it hopes will help it take advantage of incentives under the Affordable Care Act.

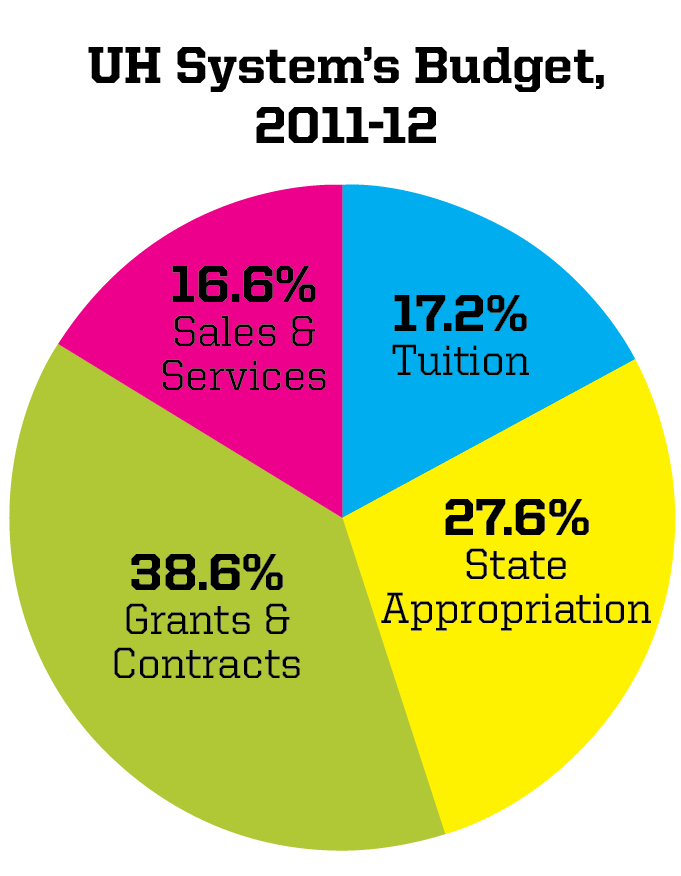

Probably the most impressive (and necessary) diversification effort has come from the cash-strapped UH System. CFO Howard Toto points out that even though the school’s state appropriation reached $359 million in 2011, it was far outstripped by the $502 million the university attracted in grants and contracts. “Basically, the trends have been going in opposite directions,” Toto says. “Contracts and grants have been going up, while state appropriations are going down, especially as a percentage of the state’s budget.” Rather than buck the trend, he says, UH expects to increase the annual revenue from contracts and grants to more than $1 billion in the next five to eight years.

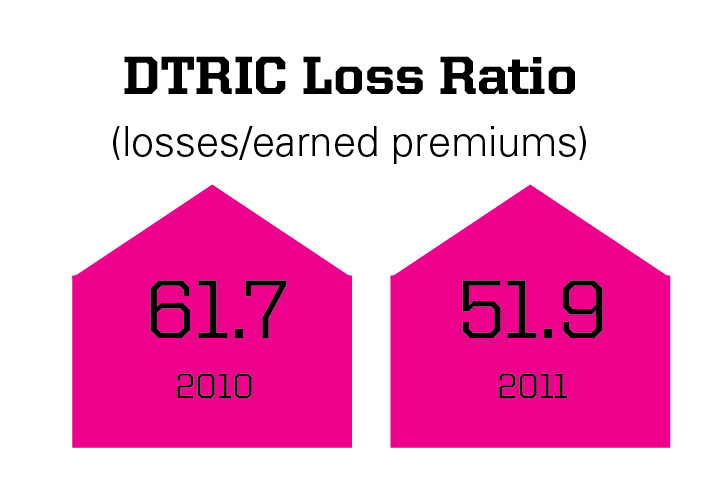

Some companies have profited from the flip side of diversification: specialization and focus on core areas. DTRIC’s innovated by initiating drive-through claims assessment at its Kapiolani office, but the real key to the company’s success has been its attention to the basics, especially lowering expenses. For 2011, DTRIC’s combined ratio, which compares losses and expenses to revenues, was one of the lowest in the state, at 93.3.

According to DTRIC VP Linh DePledge, the key is knowing where to diversify. “What is it that we’re good at?” she says. “What’s our core expertise? What business do we know better than our competitors?” She points out that DTRIC is growing its commercial lines in the areas where the company is most profitable. For DTRIC, that means writing more insurance for condominiums, hotels and retail operations. It also means maintaining profitability in difficult times.

UH System’s Budget, 2011-12

DTRIC Loss Ratio

(losses/earned premiums)

25%

Percentage of its profits that Aloha Pacific FCU attributes to its Las Vegas mortgage business